Reset

Print

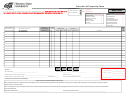

Transaction ID

Advisor Name

G Number

Transfer of Assets

G

1. Receiving Account Information

2. Account Being Transferred

Account Number

Account Number

DTC Number

Account Owner/Trust/Entity Name

Account Owner/Trust/Entity Name(s)

Social Security Number/Taxpayer ID Number

Delivering Firm Name

Additional Account Owner/Trust/Entity Name

Address

Social Security Number/Taxpayer ID Number

State/Province

Zip Code

Delivering Firm Phone

Receiving Account Type

Delivering Account Type

Check one.

Check one.

Non-Retirement Accounts

Retirement Accounts

Non-Retirement Accounts

Retirement Accounts

Individual

Traditional, SEP, or Rollover IRA

Individual

Traditional, SEP, or Rollover IRA

Joint

Roth IRA

Joint

Roth IRA

Trust

SIMPLE IRA

Trust

SIMPLE IRA

Corp/Business

Inherited IRA

Corp/Business

Inherited IRA

UGMA / UTMA

Inherited Roth IRA

UGMA / UTMA

Inherited Roth IRA

Estate

Qualified Plan*

Estate

Qualified Plan

Other_________________________________________

Other_________________________________________

* Qualified Plan options offered under the Fidelity Retirement Plan include Self-employed 401(k), Profit Sharing and Money Purchase plans.

3. Transfer Instructions

Complete A, B, C, D, or E.

If you do not instruct us otherwise, we will default to transfer in kind all eligible positions in the account. Money market mutual funds may be

liquidated. Neither NFS or Fidelity is responsible for market fluctuation on requests with written liquidation instructions. Complete a separate

Additional Assets Schedule if you need to list more securities.

All or some of the assets are Alternative Investments and a completed Alternative Investment Addendum and Custody Agreement is on file.

Note: Some alternative investments may be restricted to certain account registrations.

A. Brokerage or Trust Company Transfer

B. Mutual Fund Company Transfer

Brokerage account transfers are in kind; liquidate assets at current

Fund Name/Symbol and Account Number

# of Shares or “All”

firm prior to submitting this form if you wish to have assets

transferred in cash. For Annuities, complete Section 3.D.

In Kind

Liquidate

1. Transfer the entire account.

Skip to Section 4.

Fund Name/Symbol and Account Number

# of Shares or “All”

2. Transfer only part of my account In Kind, as detailed below:

Security Name or Symbol

# of Shares or “All”

In Kind

Liquidate

Security Name or Symbol

# of Shares or “All”

Fund Name/Symbol and Account Number

# of Shares or “All”

Security Name or Symbol

# of Shares or “All”

In Kind

Liquidate

C. Bank or Credit Union Transfer

Do NOT use this form to transfer a non-retirement bank checking account.

1. Transfer cash only.

2. Liquidate CD immediately and send cash.

All cash will be transferred unless you indicate a

different amount to transfer here:

You may be charged a penalty for early withdrawal.

Cash Transfer Amount

3. Liquidate CD at maturity and send cash.

CD Maturity Date

The request must be submitted at least

MM DD YYYY

$

.

21 days before maturity, and no more than

60 days before maturity.

1.726855.111

021450101

Page 1 of 2

1

1 2

2 3

3