Form Bw3wkst - Reconciliation Of Income Tax Withheld Bw-3 Worksheet

ADVERTISEMENT

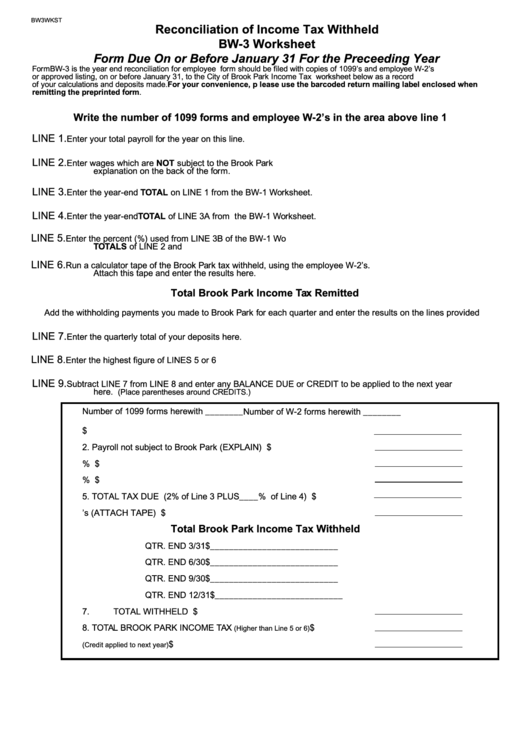

BW3WKST

Reconciliation of Income Tax Withheld

BW-3 Worksheet

Form Due On or Before January 31 For the Preceeding Year

Form BW-3 is the year end reconciliation for employee withholding. This form should be filed with copies of 1099’s and employee W-2’s

or approved listing, on or before January 31, to the City of Brook Park Income Tax Department. Keep the worksheet below as a record

calculations and deposits made. For your convenience, please use the barcoded return mailing label enclosed when

of your

remitting the preprinted form.

Write the number of 1099 forms and employee W-2’s in the area above line 1

LINE 1.

Enter your total payroll for the year on this line.

LINE 2.

Enter wages which are NOT subject to the Brook Park tax. Write a brief

explanation on the back of the form.

LINE 3.

Enter the year-end TOTAL on LINE 1 from the BW-1 Worksheet.

LINE 4.

Enter the year-end TOTAL of LINE 3A from the BW-1 Worksheet.

LINE 5.

Enter the percent (%) used from LINE 3B of the BW-1 Worksheet. Then add the year-end

TOTALS of LINE 2 and 3C... Enter the results here.

LINE 6.

Run a calculator tape of the Brook Park tax withheld, using the employee W-2’s.

Attach this tape and enter the results here.

Total Brook Park Income Tax Remitted

Add the withholding payments you made to Brook Park for each quarter and enter the results on the lines provided

LINE 7.

Enter the quarterly total of your deposits here.

LINE 8.

Enter the highest figure of LINES 5 or 6

LINE 9.

Subtract LINE 7 from LINE 8 and enter any BALANCE DUE or CREDIT to be applied to the next year

here.

(Place parentheses around CREDITS.)

Number of 1099 forms herewith ________

Number of W-2 forms herewith ________

1.

Total payroll for year ................................................................... $

2.

Payroll not subject to Brook Park (EXPLAIN) ............................ $

3.

Payroll subject to Brook Park at 2% ............................................ $

4.

Payroll subject to Brook Park at less than 2% ............................. $

5.

TOTAL TAX DUE (2% of Line 3 PLUS____% of Line 4) ........... $

6.

Total Tax withheld per W-2’s (ATTACH TAPE) ............................. $

Total Brook Park Income Tax Withheld

QTR. END 3/31

$___________________________

QTR. END 6/30

$___________________________

QTR. END 9/30

$___________________________

QTR. END 12/31

$___________________________

7.

TOTAL WITHHELD .......................................................................$

8.

TOTAL BROOK PARK INCOME TAX

.......... $

(Higher than Line 5 or 6)

9.

BALANCE DUE

.........................................$

(Credit applied to next year)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2