Instructions For Form 17 - Reconciliation Of Income Tax Withheld And W-2/1099 Transmittal - Rita

ADVERTISEMENT

RITA’s eFile

Easy, Fast, Free & Secure

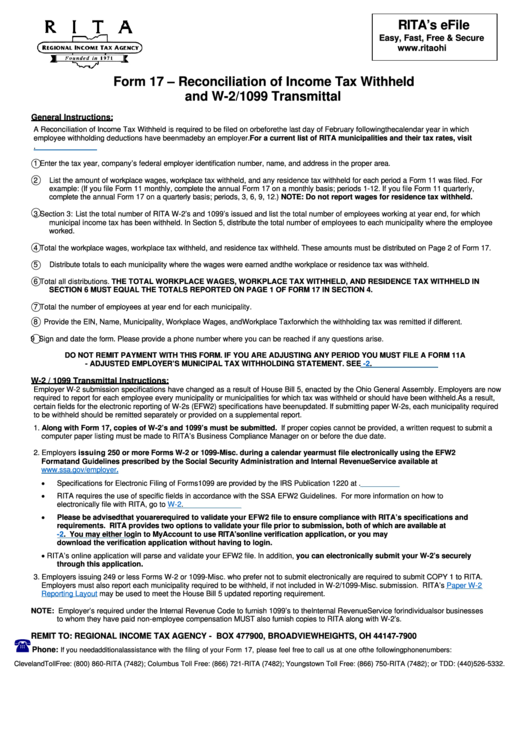

Form 17 – Reconciliation of Income Tax Withheld

and W-2/1099 Transmittal

General Instructions:

A Reconciliation of Income Tax Withheld is required to be filed on or before the last day of February following the calendar year in which

employee withholding deductions have been made by an employer. For a current list of RITA municipalities and their tax rates, visit

.

1

Enter the tax year, company’s federal employer identification number, name, and address in the proper area.

2

List the amount of workplace wages, workplace tax withheld, and any residence tax withheld for each period a Form 11 was filed. For

example: (If you file Form 11 monthly, complete the annual Form 17 on a monthly basis; periods 1-12. If you file Form 11 quarterly,

complete the annual Form 17 on a quarterly basis; periods, 3, 6, 9, 12.) NOTE: Do not report wages for residence tax withheld.

3

Section 3: List the total number of RITA W-2’s and 1099’s issued and list the total number of employees working at year end, for which

municipal income tax has been withheld. In Section 5, distribute the total number of employees to each municipality where the employee

worked.

4

Total the workplace wages, workplace tax withheld, and residence tax withheld. These amounts must be distributed on Page 2 of Form 17.

5

Distribute totals to each municipality where the wages were earned and the workplace or residence tax was withheld.

6

Total all distributions. THE TOTAL WORKPLACE WAGES, WORKPLACE TAX WITHHELD, AND RESIDENCE TAX WITHHELD IN

SECTION 6 MUST EQUAL THE TOTALS REPORTED ON PAGE 1 OF FORM 17 IN SECTION 4.

7

Total the number of employees at year end for each municipality.

8

Provide the EIN, Name, Municipality, Workplace Wages, and Workplace Tax for which the withholding tax was remitted if different.

9

Sign and date the form. Please provide a phone number where you can be reached if any questions arise

.

DO NOT REMIT PAYMENT WITH THIS FORM. IF YOU ARE ADJUSTING ANY PERIOD YOU MUST FILE A FORM 11A

- ADJUSTED EMPLOYER’S MUNICIPAL TAX WITHHOLDING STATEMENT. SEE /W-2.

W-2 / 1099 Transmittal Instructions:

Employer W-2 submission specifications have changed as a result of House Bill 5, enacted by the Ohio General Assembly. Employers are now

required to report for each employee every municipality or municipalities for which tax was withheld or should have been withheld. As a result,

certain fields for the electronic reporting of W-2s (EFW2) specifications have been updated. If submitting paper W-2s, each municipality required

to be withheld should be remitted separately or provided on a supplemental report.

1. Along with Form 17, copies of W-2’s and 1099’s must be submitted. If proper copies cannot be provided, a written request to submit a

computer paper listing must be made to RITA’s Business Compliance Manager on or before the due date.

2. Employers issuing 250 or more Forms W-2 or 1099-Misc. during a calendar year must file electronically using the EFW2

Format and Guidelines prescribed by the Social Security Administration and Internal Revenue Service available at

•

Specifications for Electronic Filing of Forms 1099 are provided by the IRS Publication 1220 at

•

RITA requires the use of specific fields in accordance with the SSA EFW2 Guidelines. For more information on how to

electronically file with RITA, go to /W-2.

•

Please be advised that you are required to validate your EFW2 file to ensure compliance with RITA’s specifications and

requirements. RITA provides two options to validate your file prior to submission, both of which are available at

/W-2. You may either login to MyAccount to use RITA’s online verification application, or you may

download the verification application without having to login.

•

RITA’s online application will parse and validate your EFW2 file. In addition, you can electronically submit your W-2’s securely

through this application.

3. Employers issuing 249 or less Forms W-2 or 1099-Misc. who prefer not to submit electronically are required to submit COPY 1 to RITA.

Employers must also report each municipality required to be withheld, if not included in W-2/1099-Misc. submission. RITA’s

Paper W-2

Reporting Layout

may be used to meet the House Bill 5 updated reporting requirement.

NOTE: Employer’s required under the Internal Revenue Code to furnish 1099’s to the Internal Revenue Service for individuals or businesses

to whom they have paid non-employee compensation MUST also furnish copies to RITA along with W-2’s.

REMIT TO: REGIONAL INCOME TAX AGENCY - P.O. BOX 477900, BROADVIEW HEIGHTS, OH 44147-7900

Phone:

If you need additional assistance with the filing of your Form 17, please feel free to call us at one of the following phone numbers:

Cleveland Toll Free: (800) 860-RITA (7482); Columbus Toll Free: (866) 721-RITA (7482); Youngstown Toll Free: (866) 750-RITA (7482); or TDD: (440)526-5332.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2