Form 17 - Reconciliation Of Income Tax Withheld And W-2/1099 Transmittal

ADVERTISEMENT

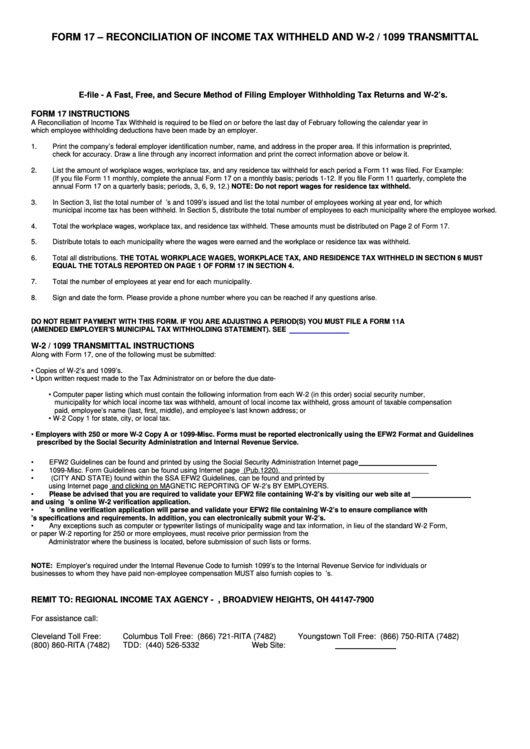

FORM 17 – RECONCILIATION OF INCOME TAX WITHHELD AND W-2 / 1099 TRANSMITTAL

E-file - A Fast, Free, and Secure Method of Filing Employer Withholding Tax Returns and W-2’s.

FORM 17 INSTRUCTIONS

A Reconciliation of Income Tax Withheld is required to be filed on or before the last day of February following the calendar year in

which employee withholding deductions have been made by an employer.

1.

Print the company’s federal employer identification number, name, and address in the proper area. If this information is preprinted,

check for accuracy. Draw a line through any incorrect information and print the correct information above or below it.

2.

List the amount of workplace wages, workplace tax, and any residence tax withheld for each period a Form 11 was filed. For Example:

(If you file Form 11 monthly, complete the annual Form 17 on a monthly basis; periods 1-12. If you file Form 11 quarterly, complete the

annual Form 17 on a quarterly basis; periods, 3, 6, 9, 12.) NOTE: Do not report wages for residence tax withheld.

3.

In Section 3, list the total number of R.I.T.A. W-2’s and 1099’s issued and list the total number of employees working at year end, for which

municipal income tax has been withheld. In Section 5, distribute the total number of employees to each municipality where the employee worked.

4.

Total the workplace wages, workplace tax, and residence tax withheld. These amounts must be distributed on Page 2 of Form 17.

5.

Distribute totals to each municipality where the wages were earned and the workplace or residence tax was withheld.

6.

Total all distributions. THE TOTAL WORKPLACE WAGES, WORKPLACE TAX, AND RESIDENCE TAX WITHHELD IN SECTION 6 MUST

EQUAL THE TOTALS REPORTED ON PAGE 1 OF FORM 17 IN SECTION 4.

7.

Total the number of employees at year end for each municipality.

8.

Sign and date the form. Please provide a phone number where you can be reached if any questions arise.

DO NOT REMIT PAYMENT WITH THIS FORM. IF YOU ARE ADJUSTING A PERIOD(S) YOU MUST FILE A FORM 11A

(AMENDED EMPLOYER’S MUNICIPAL TAX WITHHOLDING STATEMENT). SEE

W-2 / 1099 TRANSMITTAL INSTRUCTIONS

Along with Form 17, one of the following must be submitted:

• Copies of W-2’s and 1099’s.

• Upon written request made to the Tax Administrator on or before the due date-

• Computer paper listing which must contain the following information from each W-2 (in this order) social security number,

municipality for which local income tax was withheld, amount of local income tax withheld, gross amount of taxable compensation

paid, employee’s name (last, first, middle), and employee’s last known address; or

• W-2 Copy 1 for state, city, or local tax.

• Employers with 250 or more W-2 Copy A or 1099-Misc. Forms must be reported electronically using the EFW2 Format and Guidelines

prescribed by the Social Security Administration and Internal Revenue Service.

•

EFW2 Guidelines can be found and printed by using the Social Security Administration Internet page

•

1099-Misc. Form Guidelines can be found using Internet page (Pub.1220).

•

R.I.T.A. guidelines for the RS Record (CITY AND STATE) found within the SSA EFW2 Guidelines, can be found and printed by

using Internet page and clicking on MAGNETIC REPORTING OF W-2’s BY EMPLOYERS.

•

Please be advised that you are required to validate your EFW2 file containing W-2’s by visiting our web site at

and using R.I.T.A.’s online W-2 verification application.

•

R.I.T.A.’s online verification application will parse and validate your EFW2 file containing W-2’s to ensure compliance with

R.I.T.A.’s specifications and requirements. In addition, you can electronically submit your W-2’s.

•

Any exceptions such as computer or typewriter listings of municipality wage and tax information, in lieu of the standard W-2 Form,

or paper W-2 reporting for 250 or more employees, must receive prior permission from the R.I.T.A. Director of Taxation or the Tax

Administrator where the business is located, before submission of such lists or forms.

NOTE: Employer’s required under the Internal Revenue Code to furnish 1099’s to the Internal Revenue Service for individuals or

businesses to whom they have paid non-employee compensation MUST also furnish copies to R.I.T.A along with W-2’s.

REMIT TO: REGIONAL INCOME TAX AGENCY - P.O. BOX 477900, BROADVIEW HEIGHTS, OH 44147-7900

For assistance call:

Cleveland Toll Free:

Columbus Toll Free: (866) 721-RITA (7482)

Youngstown Toll Free: (866) 750-RITA (7482)

(800) 860-RITA (7482)

TDD: (440) 526-5332

Web Site:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2