Form 45-010 - Corporation Estimated Income Worksheet - 2013

ADVERTISEMENT

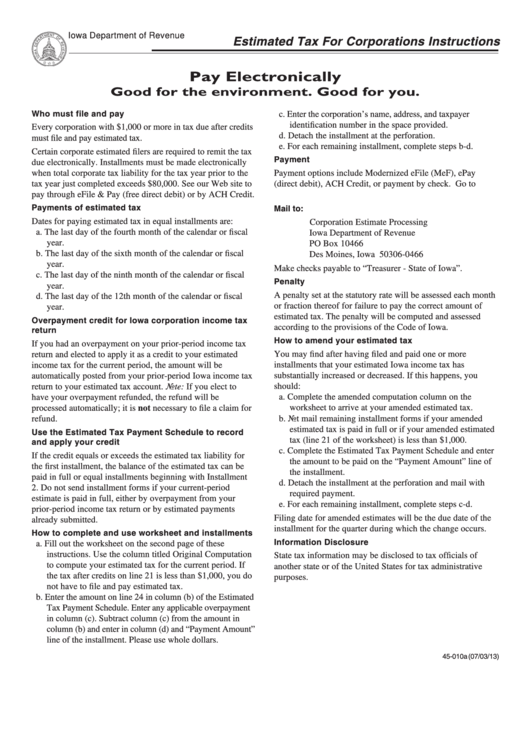

Iowa Department of Revenue

Estimated Tax For Corporations Instructions

Pay Electronically

Good for the environment. Good for you.

Who must file and pay

c. Enter the corporation’s name, address, and taxpayer

identification number in the space provided.

Every corporation with $1,000 or more in tax due after credits

d. Detach the installment at the perforation.

must file and pay estimated tax.

e. For each remaining installment, complete steps b-d.

Certain corporate estimated filers are required to remit the tax

Payment

due electronically. Installments must be made electronically

when total corporate tax liability for the tax year prior to the

Payment options include Modernized eFile (MeF), ePay

tax year just completed exceeds $80,000. See our Web site to

(direct debit), ACH Credit, or payment by check. Go to

pay through eFile & Pay (free direct debit) or by ACH Credit.

for ePayment information.

Payments of estimated tax

Mail to:

Dates for paying estimated tax in equal installments are:

Corporation Estimate Processing

a. The last day of the fourth month of the calendar or fiscal

Iowa Department of Revenue

year.

PO Box 10466

b. The last day of the sixth month of the calendar or fiscal

Des Moines, Iowa 50306-0466

year.

Make checks payable to “Treasurer - State of Iowa”.

c. The last day of the ninth month of the calendar or fiscal

Penalty

year.

A penalty set at the statutory rate will be assessed each month

d. The last day of the 12th month of the calendar or fiscal

or fraction thereof for failure to pay the correct amount of

year.

estimated tax. The penalty will be computed and assessed

Overpayment credit for Iowa corporation income tax

according to the provisions of the Code of Iowa.

return

How to amend your estimated tax

If you had an overpayment on your prior-period income tax

return and elected to apply it as a credit to your estimated

You may find after having filed and paid one or more

installments that your estimated Iowa income tax has

income tax for the current period, the amount will be

substantially increased or decreased. If this happens, you

automatically posted from your prior-period Iowa income tax

should:

return to your estimated tax account. Note: If you elect to

a. Complete the amended computation column on the

have your overpayment refunded, the refund will be

worksheet to arrive at your amended estimated tax.

processed automatically; it is not necessary to file a claim for

b. Not mail remaining installment forms if your amended

refund.

estimated tax is paid in full or if your amended estimated

Use the Estimated Tax Payment Schedule to record

tax (line 21 of the worksheet) is less than $1,000.

and apply your credit

c. Complete the Estimated Tax Payment Schedule and enter

If the credit equals or exceeds the estimated tax liability for

the amount to be paid on the “Payment Amount” line of

the first installment, the balance of the estimated tax can be

the installment.

paid in full or equal installments beginning with Installment

d. Detach the installment at the perforation and mail with

2. Do not send installment forms if your current-period

required payment.

estimate is paid in full, either by overpayment from your

e. For each remaining installment, complete steps c-d.

prior-period income tax return or by estimated payments

Filing date for amended estimates will be the due date of the

already submitted.

installment for the quarter during which the change occurs.

How to complete and use worksheet and installments

Information Disclosure

a. Fill out the worksheet on the second page of these

instructions. Use the column titled Original Computation

State tax information may be disclosed to tax officials of

to compute your estimated tax for the current period. If

another state or of the United States for tax administrative

the tax after credits on line 21 is less than $1,000, you do

purposes.

not have to file and pay estimated tax.

b. Enter the amount on line 24 in column (b) of the Estimated

Tax Payment Schedule. Enter any applicable overpayment

in column (c). Subtract column (c) from the amount in

column (b) and enter in column (d) and “Payment Amount”

line of the installment. Please use whole dollars.

45-010a (07/03/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2