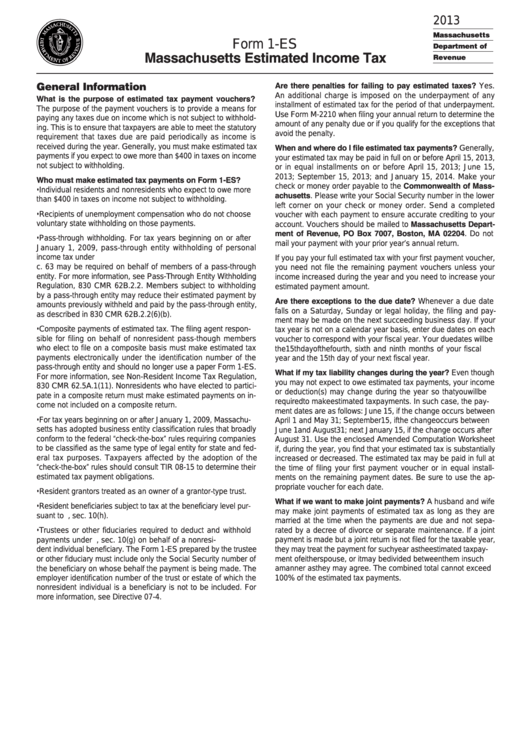

2013

Massachusetts

Form 1-ES

Department of

Massachusetts Estimated Income Tax

Revenue

General Information

Are there penalties for failing to pay estimated taxes? Yes.

An additional charge is imposed on the underpayment of any

What is the purpose of estimated tax payment vouchers?

installment of estimated tax for the period of that underpayment.

The purpose of the payment vouchers is to provide a means for

Use Form M-2210 when filing your annual return to determine the

paying any taxes due on income which is not subject to withhold-

amount of any penalty due or if you qualify for the exceptions that

ing. This is to ensure that taxpayers are able to meet the statutory

avoid the penalty.

requirement that taxes due are paid periodically as income is

received during the year. Generally, you must make estimated tax

When and where do I file estimated tax payments? Generally,

payments if you expect to owe more than $400 in taxes on income

your estimated tax may be paid in full on or before April 15, 2013,

not subject to withholding.

or in equal installments on or before April 15, 2013; June 15,

2013; September 15, 2013; and January 15, 2014. Make your

Who must make estimated tax payments on Form 1-ES?

check or money order payable to the Commonwealth of Mass-

• Individual residents and nonresidents who expect to owe more

achusetts. Please write your Social Security number in the lower

than $400 in taxes on income not subject to withholding.

left corner on your check or money order. Send a completed

• Recipients of unemployment compensation who do not choose

voucher with each payment to ensure accurate crediting to your

voluntary state withholding on those payments.

account. Vouchers should be mailed to Massachusetts Depart-

ment of Revenue, PO Box 7007, Boston, MA 02204. Do not

• Pass-through withholding. For tax years beginning on or after

mail your payment with your prior year’s annual return.

January 1, 2009, pass-through entity withholding of personal

income tax under M.G.L. c. 62 and corporate excise under M.G.L.

If you pay your full estimated tax with your first payment voucher,

c. 63 may be required on behalf of members of a pass-through

you need not file the remaining payment vouchers unless your

entity. For more information, see Pass-Through Entity Withholding

income increased during the year and you need to increase your

Regulation, 830 CMR 62B.2.2. Members subject to withholding

estimated payment amount.

by a pass-through entity may reduce their estimated payment by

Are there exceptions to the due date? Whenever a due date

amounts previously withheld and paid by the pass-through entity,

falls on a Saturday, Sunday or legal holiday, the filing and pay-

as described in 830 CMR 62B.2.2(6)(b).

ment may be made on the next succeeding business day. If your

• Composite payments of estimated tax. The filing agent respon-

tax year is not on a calendar year basis, enter due dates on each

sible for filing on behalf of nonresident pass-though members

voucher to correspond with your fiscal year. Your due dates will be

who elect to file on a composite basis must make estimated tax

the 15th day of the fourth, sixth and ninth months of your fiscal

payments electronically under the identification number of the

year and the 15th day of your next fiscal year.

pass-through entity and should no longer use a paper Form 1-ES.

What if my tax liability changes during the year? Even though

For more information, see Non-Resident Income Tax Regulation,

you may not expect to owe estimated tax payments, your income

830 CMR 62.5A.1(11). Nonresidents who have elected to partici-

or deduction(s) may change during the year so that you will be

pate in a composite return must make estimated payments on in-

required to make estimated tax payments. In such case, the pay-

come not included on a composite return.

ment dates are as follows: June 15, if the change occurs between

• For tax years beginning on or after January 1, 2009, Massachu-

April 1 and May 31; September 15, if the change occurs between

setts has adopted business entity classification rules that broadly

June 1 and August 31; next January 15, if the change occurs after

conform to the federal “check-the-box” rules requiring companies

August 31. Use the enclosed Amended Computation Worksheet

to be classified as the same type of legal entity for state and fed-

if, during the year, you find that your estimated tax is substantially

eral tax purposes. Taxpayers affected by the adoption of the

increased or decreased. The estimated tax may be paid in full at

“check-the-box” rules should consult TIR 08-15 to determine their

the time of filing your first payment voucher or in equal install-

estimated tax payment obligations.

ments on the remaining payment dates. Be sure to use the ap-

propriate voucher for each date.

• Resident grantors treated as an owner of a grantor-type trust.

What if we want to make joint payments? A husband and wife

• Resident beneficiaries subject to tax at the beneficiary level pur-

may make joint payments of estimated tax as long as they are

suant to M.G.L. c. 62, sec. 10(h).

married at the time when the payments are due and not sepa-

• Trustees or other fiduciaries required to deduct and withhold

rated by a decree of divorce or separate maintenance. If a joint

payments under M.G.L. c. 62, sec. 10(g) on behalf of a nonresi-

payment is made but a joint return is not filed for the taxable year,

they may treat the payment for such year as the estimated tax pay-

dent individual beneficiary. The Form 1-ES prepared by the trustee

or other fiduciary must include only the Social Security number of

ment of either spouse, or it may be divided between them in such

the beneficiary on whose behalf the payment is being made. The

a manner as they may agree. The combined total cannot exceed

employer identification number of the trust or estate of which the

100% of the estimated tax payments.

nonresident individual is a beneficiary is not to be included. For

more information, see Directive 07-4.

1

1 2

2 3

3