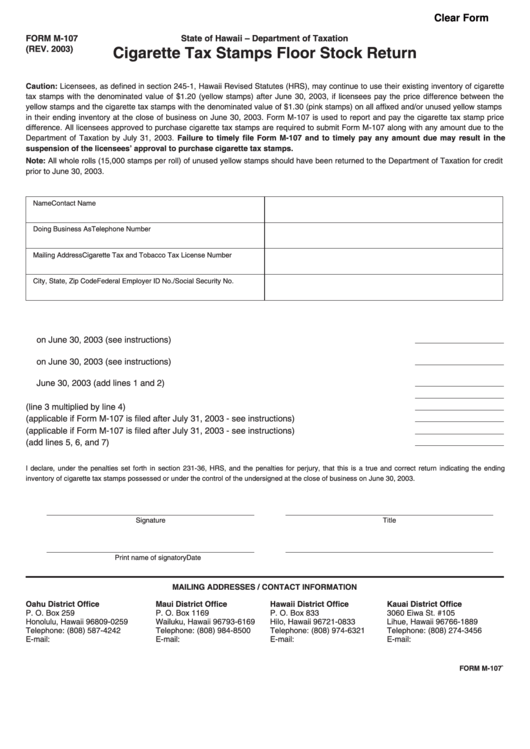

Clear Form

FORM M-107

State of Hawaii – Department of Taxation

(REV. 2003)

Cigarette Tax Stamps Floor Stock Return

Caution: Licensees, as defined in section 245-1, Hawaii Revised Statutes (HRS), may continue to use their existing inventory of cigarette

tax stamps with the denominated value of $1.20 (yellow stamps) after June 30, 2003, if licensees pay the price difference between the

yellow stamps and the cigarette tax stamps with the denominated value of $1.30 (pink stamps) on all affixed and/or unused yellow stamps

in their ending inventory at the close of business on June 30, 2003. Form M-107 is used to report and pay the cigarette tax stamp price

difference. All licensees approved to purchase cigarette tax stamps are required to submit Form M-107 along with any amount due to the

Department of Taxation by July 31, 2003. Failure to timely file Form M-107 and to timely pay any amount due may result in the

suspension of the licensees’ approval to purchase cigarette tax stamps.

Note: All whole rolls (15,000 stamps per roll) of unused yellow stamps should have been returned to the Department of Taxation for credit

prior to June 30, 2003.

Name

Contact Name

Doing Business As

Telephone Number

Mailing Address

Cigarette Tax and Tobacco Tax License Number

City, State, Zip Code

Federal Employer ID No./Social Security No.

1. Number of affixed yellow cigarette tax stamps in ending inventory at the close of business

on June 30, 2003 (see instructions)...................................................................................................

2. Number of unused yellow cigarette tax stamps in ending inventory at the close of business

on June 30, 2003 (see instructions)...................................................................................................

3. Total number of yellow cigarette tax stamps in ending inventory at the close of business on

June 30, 2003 (add lines 1 and 2) .....................................................................................................

4. Difference in cigarette tax stamp price - see instructions for explanation of price difference ............

.1013

5. Amount due (line 3 multiplied by line 4) .............................................................................................

6. Penalty (applicable if Form M-107 is filed after July 31, 2003 - see instructions) ..............................

7. Interest (applicable if Form M-107 is filed after July 31, 2003 - see instructions) ..............................

8. Total amount due (add lines 5, 6, and 7) ...........................................................................................

I declare, under the penalties set forth in section 231-36, HRS, and the penalties for perjury, that this is a true and correct return indicating the ending

inventory of cigarette tax stamps possessed or under the control of the undersigned at the close of business on June 30, 2003.

Signature

Title

Print name of signatory

Date

MAILING ADDRESSES / CONTACT INFORMATION

Oahu District Office

Maui District Office

Hawaii District Office

Kauai District Office

P. O. Box 259

P. O. Box 1169

P. O. Box 833

3060 Eiwa St. #105

Honolulu, Hawaii 96809-0259

Wailuku, Hawaii 96793-6169

Hilo, Hawaii 96721-0833

Lihue, Hawaii 96766-1889

Telephone: (808) 587-4242

Telephone: (808) 984-8500

Telephone: (808) 974-6321

Telephone: (808) 274-3456

E-mail:

E-mail:

E-mail:

E-mail:

Taxpayer_Services@tax.state.hi.us

Maui_Office@tax.state.hi.us

Hilo_Office@tax.state.hi.us

Kauai_Office@tax.state.hi.us

FORM M-107`

1

1