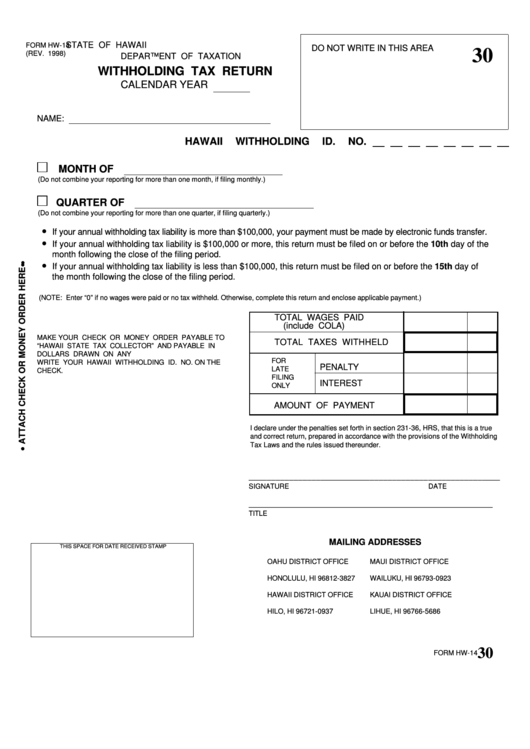

STATE OF HAWAII

FORM HW-14

DO NOT WRITE IN THIS AREA

30

(REV. 1998)

DEPARTMENT OF TAXATION

WITHHOLDING TAX RETURN

CALENDAR YEAR

NAME:

HAWAII WITHHOLDING ID. NO. __ __ __ __ __ __ __ __

MONTH OF

(Do not combine your reporting for more than one month, if filing monthly.)

QUARTER OF

(Do not combine your reporting for more than one quarter, if filing quarterly.)

•

If your annual withholding tax liability is more than $100,000, your payment must be made by electronic funds transfer.

•

If your annual withholding tax liability is $100,000 or more, this return must be filed on or before the 10th day of the

month following the close of the filing period.

•

If your annual withholding tax liability is less than $100,000, this return must be filed on or before the 15th day of

the month following the close of the filing period.

(NOTE: Enter “0” if no wages were paid or no tax withheld. Otherwise, complete this return and enclose applicable payment.)

TOTAL WAGES PAID

(include COLA)

MAKE YOUR CHECK OR MONEY ORDER PAYABLE TO

TOTAL TAXES WITHHELD

“HAWAII STATE TAX COLLECTOR” AND PAYABLE IN U.S.

DOLLARS DRAWN ON ANY U.S. BANK.

FOR

WRITE YOUR HAWAII WITHHOLDING ID. NO. ON THE

PENALTY

LATE

CHECK.

FILING

INTEREST

ONLY

AMOUNT OF PAYMENT

I declare under the penalties set forth in section 231-36, HRS, that this is a true

and correct return, prepared in accordance with the provisions of the Withholding

Tax Laws and the rules issued thereunder.

________________________________________

________________

SIGNATURE

DATE

_________________________________________________________

TITLE

MAILING ADDRESSES

THIS SPACE FOR DATE RECEIVED STAMP

OAHU DISTRICT OFFICE

MAUI DISTRICT OFFICE

P.O. BOX 3827

P.O. BOX 923

HONOLULU, HI 96812-3827

WAILUKU, HI 96793-0923

HAWAII DISTRICT OFFICE

KAUAI DISTRICT OFFICE

P.O. BOX 937

P.O. BOX 1686

HILO, HI 96721-0937

LIHUE, HI 96766-5686

30

FORM HW-14

1

1