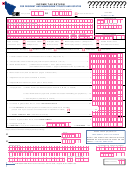

Form 1041me - Income Tax Return For Resident And Nonresident Estates And Trusts - 2011 Page 2

ADVERTISEMENT

FORM 1041ME, page 2

-

99

Enclose with your Form 1041ME

-

*1109101*

ESTATE/ TRUST EIN

SCHEDULE 1 - Fiduciary Adjustment

(Enter combined amounts for both the benefi ciaries and the estate or trust)

1 ADDITIONS — Income exempt from federal income tax, but taxable by Maine:

,

.00

a Income from municipal and state bonds, other than Maine .....................................................................................1a

,

.00

b Net Operating Loss Adjustment (attach schedule) ..................................................................................................1b

,

.00

c Maine Public Employees Retirement System Contributions ................................................................................... 1c

,

.00

d Domestic Production Activities Deduction Add-back (see instructions) ...................................................................1d

,

.00

e Bonus Depreciation Add-back (see instructions) .....................................................................................................1e

,

.00

f Maine Capital Investment Credit Bonus Depreciation Add-Back .............................................................................1f

,

.00

g Other. List

_________________________ (see instructions) ..............................................................................1g

,

.00

h Total additions (add lines 1a through 1g) ................................................................................................................1h

2 DEDUCTIONS — Income exempt from Maine income tax, but taxable by federal law:

,

.00

a U.S. Government Bond interest included in federal taxable income .......................................................................2a

,

.00

b Social Security and Railroad Retirement Benefi ts included in federal taxable income (see instructions) ...............2b

c Interest from Maine Municipal General Obligation , Private Activity and Airport Authority Bonds included in

,

.00

federal taxable income .............................................................................................................................................. 2c

d Maine Public Employees Retirement System Pick-Up Contributions paid during 2011 which have been

,

.00

previously taxed by the state ...................................................................................................................................2d

,

.00

e Contributions to Qualifi ed Tuition Programs - 529 Plans (see instructions) ............................................................2e

,

.00

f Bonus Depreciation and IRC § 179 Recapture (see instructions) ............................................................................2f

,

.00

g Other. List ______________________________________ (see instructions) .....................................................2g

,

.00

h Total Deductions (add lines 2a through 2g) .............................................................................................................2h

,

.00

3 Net Fiduciary Adjustment (subtract line 2h from line 1h — see instructions [may be a negative amount]) ...............3

All estates or trusts: Multiply line 3 by Schedule 2, Column 3, line f.

Resident estates or trusts: Enter on page 1, line 2.

Nonresident estates or trusts: Enter on Schedule NR, line 7, Column A.

Third Party

Do you want to allow another person to discuss this return with Maine Revenue Services?

Yes (complete the following).

No.

Designee

Designee’s name ______________________ Phone no. (

) __________________ Personal Identifi cation number _______________

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief they are true, correct, and

complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

X ___________________________________

________________

/

/

SIGNATURE OF FIDUCIARY OR OFFICER REPRESENTING ESTATE OR TRUST

DATE

DATE ESTATE OR TRUST CREATED:

X ___________________________________

________________

SIGNATURE OF PREPARER OTHER THAN FIDUCIARY

DATE

________________________________________________

____________________________

__________________________

PRINT PREPARER’S NAME

PREPARER’S PHONE NUMBER

PREPARER’S SSN OR PTIN

If a check is enclosed, make check payable to:

If a check is not enclosed,

Treasurer, State of Maine

Mail To: Maine Revenue Services

Write the employer identifi cation number of

Mail To : Maine Revenue Services

PO Box 1064

the estate or trust on the check. DO NOT

P.O. Box 1065

Augusta, ME 04332-1064

SEND CASH.

Augusta, ME 04332-1065

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3