Business Tax Return Form - City Of Forest Park Income Tax Division - 2007 Page 2

ADVERTISEMENT

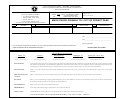

SCHEDULE X—RECONCILIATION WITH FEDERAL INCOME TAX RETURN AS PROVIDED BY ORC SECTION 718

ITEMS NOT DEDUCTIBLE

ADD

ITEMS NOT TAXABLE

DEDUCT

A. Capital Losses (Sec 1221 or 1231

$

H. Capital Gains……………………………………..

$

included)……………………………………..

B. Taxes on or measured by net

I .

Interest income ………………………………..

Income……………………………..

C. Guaranteed Payments or accruals to

partners, retired partners,

J. Dividend income ………………………………….

members or other owners……….

D. Expenses attributable to non-taxable

income (5% of total.)….

………………………………………………………….

E. Real Estate Investment Trust

distributions……………………….

…………………………………………………………..

F. Federal deducted amounts paid or accrued

to or for qualified self-employed retirement

plans, health insurance plans, and life

insurance for owners or owner-employees

of non-C corp entities. ………..

G. Total additions……………………..

$

K. Total deductions………………………………….

$

L. Combine Lines G and K and enter net on Part A, Line 2 $________________________

SCHEDULE Y—BUSINESS APPORTIONMENT FORMULA

COMPLETE ALL STEPS

a. Located

b. Located in

Percentage

Everywhere

Forest Park

(b / a)

Original average cost of real and tangible personal

STEP 1.

property…………………………………………………………..

Gross annual rentals paid multiplied by 8………………….…

%

TOTAL STEP 1…………………………………………………..

Wages, salaries, and other compensation paid

STEP 2.

%

*See Schedule Y-1 below…………………………..

Gross receipts from sales made and/or work or services

STEP 3.

%

performed…………………………………………………………

STEP 4.

Total percentages (Add percentages from Steps 1-3)

%

STEP 5.

Average percentage (Divide total percentage (Step 4) by number of percentages used—Carry to Part A, Line 4)

%

*SCHEDULE Y-1 RECONCILIATION TO FORM W-3 (WITHHOLDING RECONCILIATION)

Total wages allocated to Forest Park (From Federal Return or apportionment formula) …………………………………………………

$

Total wages shown on Form W-3 (Withholding Reconciliation)………………………………………………………………………………

$

Please explain any difference:

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

Are there any employees leased in the year covered by this return? ______YES ______ NO

If YES, please provide the name, address and FID number of the leasing company.

Name:__________________________________________________

Address:________________________________________________

________________________________________________

FID Number:__________________ Phone #____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3