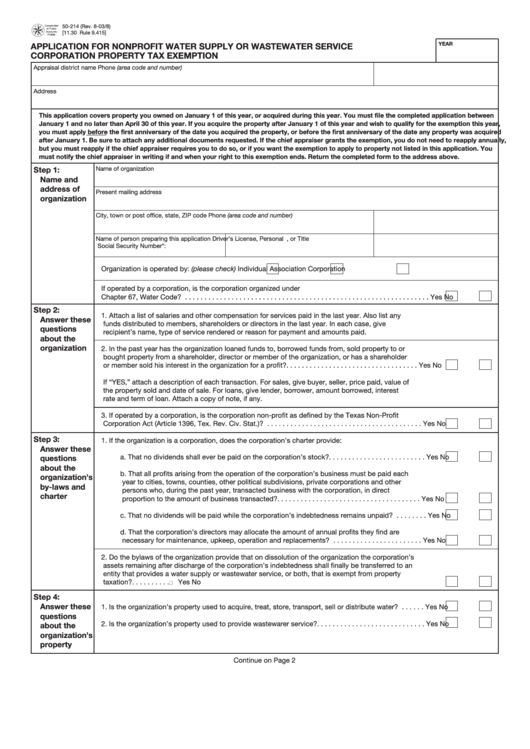

Form 50-214 - Application For Nonprofit Water Supply Or Wastewater Service

ADVERTISEMENT

50-214 (Rev. 8-03/8)

[11.30 Rule 9.415]

YEAR

APPLICATION FOR NONPROFIT WATER SUPPLY OR WASTEWATER SERVICE

CORPORATION PROPERTY TAX EXEMPTION

Appraisal district name

Phone (area code and number)

Address

This application covers property you owned on January 1 of this year, or acquired during this year. You must file the completed application between

January 1 and no later than April 30 of this year. If you acquire the property after January 1 of this year and wish to qualify for the exemption this year,

you must apply before the first anniversary of the date you acquired the property, or before the first anniversary of the date any property was acquired

after January 1. Be sure to attach any additional documents requested. If the chief appraiser grants the exemption, you do not need to reapply annually,

but you must reapply if the chief appraiser requires you to do so, or if you want the exemption to apply to property not listed in this application. You

must notify the chief appraiser in writing if and when your right to this exemption ends. Return the completed form to the address above.

Step 1:

Name of organization

Name and

address of

Present mailing address

organization

City, town or post office, state, ZIP code

Phone (area code and number)

Name of person preparing this application

Driver’s License, Personal I.D. Certificate, or

Title

Social Security Number*:

Organization is operated by: (please check)

Individual

Association

Corporation

If operated by a corporation, is the corporation organized under

Chapter 67, Water Code? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes

No

Step 2:

1. Attach a list of salaries and other compensation for services paid in the last year. Also list any

Answer these

funds distributed to members, shareholders or directors in the last year. In each case, give

questions

recipient’s name, type of service rendered or reason for payment and amounts paid.

about the

organization

2. In the past year has the organization loaned funds to, borrowed funds from, sold property to or

bought property from a shareholder, director or member of the organization, or has a shareholder

or member sold his interest in the organization for a profit?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes

No

If “YES,” attach a description of each transaction. For sales, give buyer, seller, price paid, value of

the property sold and date of sale. For loans, give lender, borrower, amount borrowed, interest

rate and term of loan. Attach a copy of note, if any.

3. If operated by a corporation, is the corporation non-profit as defined by the Texas Non-Profit

Corporation Act (Article 1396, Tex. Rev. Civ. Stat.)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes

No

Step 3:

1. If the organization is a corporation, does the corporation’s charter provide:

Answer these

a. That no dividends shall ever be paid on the corporation’s stock? . . . . . . . . . . . . . . . . . . . . . . . . . Yes

No

questions

about the

b. That all profits arising from the operation of the corporation’s business must be paid each

organization’s

year to cities, towns, counties, other political subdivisions, private corporations and other

by-laws and

persons who, during the past year, transacted business with the corporation, in direct

charter

proportion to the amount of business transacted?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes

No

c. That no dividends will be paid while the corporation’s indebtedness remains unpaid? . . . . . . . . Yes

No

d. That the corporation’s directors may allocate the amount of annual profits they find are

necessary for maintenance, upkeep, operation and replacements? . . . . . . . . . . . . . . . . . . . . . . . Yes

No

2. Do the bylaws of the organization provide that on dissolution of the organization the corporation’s

assets remaining after discharge of the corporation’s indebtedness shall finally be transferred to an

entity that provides a water supply or wastewater service, or both, that is exempt from property

taxation?. . . . . . . . . .

Yes

No

Step 4:

Answer these

1. Is the organization’s property used to acquire, treat, store, transport, sell or distribute water? . . . . . . Yes

No

questions

2. Is the organization’s property used to provide wastewarer service?. . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes

No

about the

organization’s

property

Continue on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4