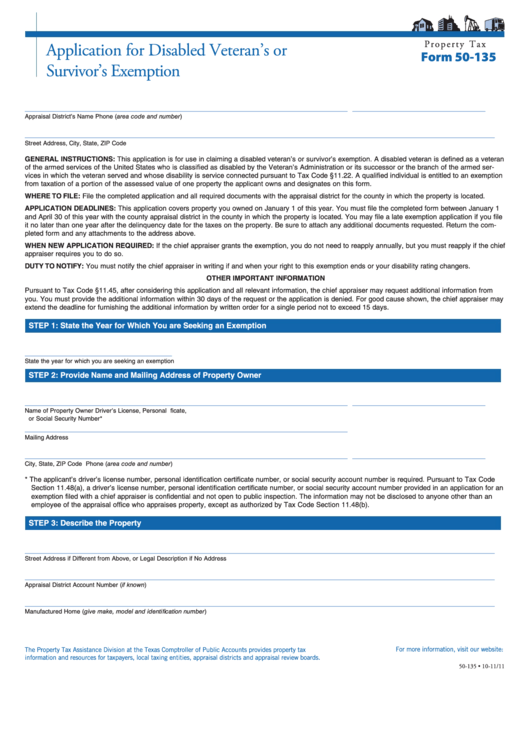

P r o p e r t y T a x

Application for Disabled Veteran’s or

Form 50-135

Survivor’s Exemption

____________________________________________________________________

____________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Street Address, City, State, ZIP Code

GENERAL INSTRUCTIONS: This application is for use in claiming a disabled veteran’s or survivor’s exemption. A disabled veteran is defined as a veteran

of the armed services of the United States who is classified as disabled by the Veteran’s Administration or its successor or the branch of the armed ser-

vices in which the veteran served and whose disability is service connected pursuant to Tax Code §11.22. A qualified individual is entitled to an exemption

from taxation of a portion of the assessed value of one property the applicant owns and designates on this form.

WHERE TO FILE: File the completed application and all required documents with the appraisal district for the county in which the property is located.

APPLICATION DEADLINES: This application covers property you owned on January 1 of this year. You must file the completed form between January 1

and April 30 of this year with the county appraisal district in the county in which the property is located. You may file a late exemption application if you file

it no later than one year after the delinquency date for the taxes on the property. Be sure to attach any additional documents requested. Return the com-

pleted form and any attachments to the address above.

WHEN NEW APPLICATION REQUIRED: If the chief appraiser grants the exemption, you do not need to reapply annually, but you must reapply if the chief

appraiser requires you to do so.

DUTY TO NOTIFY: You must notify the chief appraiser in writing if and when your right to this exemption ends or your disability rating changers.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code §11.45, after considering this application and all relevant information, the chief appraiser may request additional information from

you. You must provide the additional information within 30 days of the request or the application is denied. For good cause shown, the chief appraiser may

extend the deadline for furnishing the additional information by written order for a single period not to exceed 15 days.

STEP 1: State the Year for Which You are Seeking an Exemption

_______________________________

State the year for which you are seeking an exemption

STEP 2: Provide Name and Mailing Address of Property Owner

____________________________________________________________________

____________________________

Name of Property Owner

Driver’s License, Personal I.D. Certificate,

or Social Security Number*

____________________________________________________________________

Mailing Address

____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

* The applicant’s driver’s license number, personal identification certificate number, or social security account number is required. Pursuant to Tax Code

Section 11.48(a), a driver’s license number, personal identification certificate number, or social security account number provided in an application for an

exemption filed with a chief appraiser is confidential and not open to public inspection. The information may not be disclosed to anyone other than an

employee of the appraisal office who appraises property, except as authorized by Tax Code Section 11.48(b).

STEP 3: Describe the Property

___________________________________________________________________________________________________

Street Address if Different from Above, or Legal Description if No Address

___________________________________________________________________________________________________

Appraisal District Account Number (if known)

___________________________________________________________________________________________________

Manufactured Home (give make, model and identification number)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-135 • 10-11/11

1

1 2

2 3

3