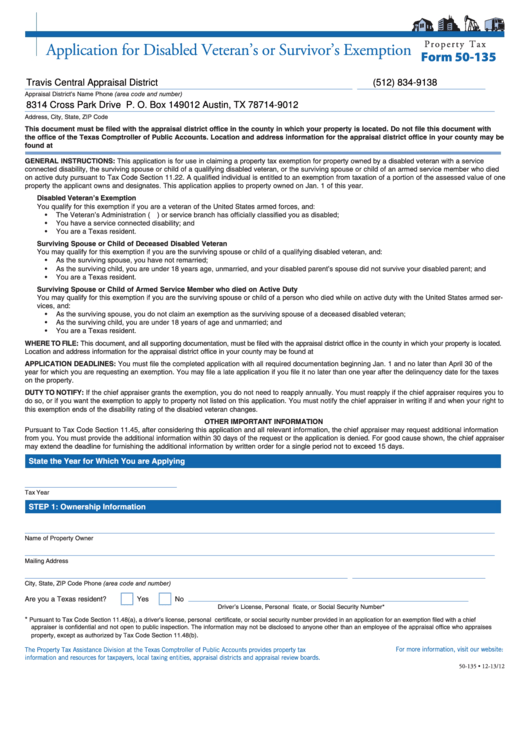

P r o p e r t y T a x

Application for Disabled Veteran’s or Survivor’s Exemption

Form 50-135

Travis Central Appraisal District

(512) 834-9138

_____________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

8314 Cross Park Drive P. O. Box 149012 Austin, TX 78714-9012

___________________________________________________________________________________________________

Address, City, State, ZIP Code

This document must be filed with the appraisal district office in the county in which your property is located. Do not file this document with

the office of the Texas Comptroller of Public Accounts. Location and address information for the appraisal district office in your county may be

found at

GENERAL INSTRUCTIONS: This application is for use in claiming a property tax exemption for property owned by a disabled veteran with a service

connected disability, the surviving spouse or child of a qualifying disabled veteran, or the surviving spouse or child of an armed service member who died

on active duty pursuant to Tax Code Section 11.22. A qualified individual is entitled to an exemption from taxation of a portion of the assessed value of one

property the applicant owns and designates. This application applies to property owned on Jan. 1 of this year.

Disabled Veteran’s Exemption

You qualify for this exemption if you are a veteran of the United States armed forces, and:

• The Veteran’s Administration (V.A.) or service branch has officially classified you as disabled;

• You have a service connected disability; and

• You are a Texas resident.

Surviving Spouse or Child of Deceased Disabled Veteran

You may qualify for this exemption if you are the surviving spouse or child of a qualifying disabled veteran, and:

• As the surviving spouse, you have not remarried;

• As the surviving child, you are under 18 years age, unmarried, and your disabled parent’s spouse did not survive your disabled parent; and

• You are a Texas resident.

Surviving Spouse or Child of Armed Service Member who died on Active Duty

You may qualify for this exemption if you are the surviving spouse or child of a person who died while on active duty with the United States armed ser-

vices, and:

• As the surviving spouse, you do not claim an exemption as the surviving spouse of a deceased disabled veteran;

• As the surviving child, you are under 18 years of age and unmarried; and

• You are a Texas resident.

WHERE TO FILE: This document, and all supporting documentation, must be filed with the appraisal district office in the county in which your property is located.

Location and address information for the appraisal district office in your county may be found at

APPLICATION DEADLINES: You must file the completed application with all required documentation beginning Jan. 1 and no later than April 30 of the

year for which you are requesting an exemption. You may file a late application if you file it no later than one year after the delinquency date for the taxes

on the property.

DUTY TO NOTIFY: If the chief appraiser grants the exemption, you do not need to reapply annually. You must reapply if the chief appraiser requires you to

do so, or if you want the exemption to apply to property not listed on this application. You must notify the chief appraiser in writing if and when your right to

this exemption ends of the disability rating of the disabled veteran changes.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code Section 11.45, after considering this application and all relevant information, the chief appraiser may request additional information

from you. You must provide the additional information within 30 days of the request or the application is denied. For good cause shown, the chief appraiser

may extend the deadline for furnishing the additional information by written order for a single period not to exceed 15 days.

State the Year for Which You are Applying

________________________________

Tax Year

STEP 1: Ownership Information

___________________________________________________________________________________________________

Name of Property Owner

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

___________________________________________________________

Are you a Texas resident?

Yes

No

Driver’s License, Personal I.D. Certificate, or Social Security Number*

*

Pursuant to Tax Code Section 11.48(a), a driver’s license, personal I.D. certificate, or social security number provided in an application for an exemption filed with a chief

appraiser is confidential and not open to public inspection. The information may not be disclosed to anyone other than an employee of the appraisal office who appraises

.

property, except as authorized by Tax Code Section 11.48(b)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-135 • 12-13/12

1

1 2

2