Form Cit-7 - New Mexico Job Mentorship Tax Credit

ADVERTISEMENT

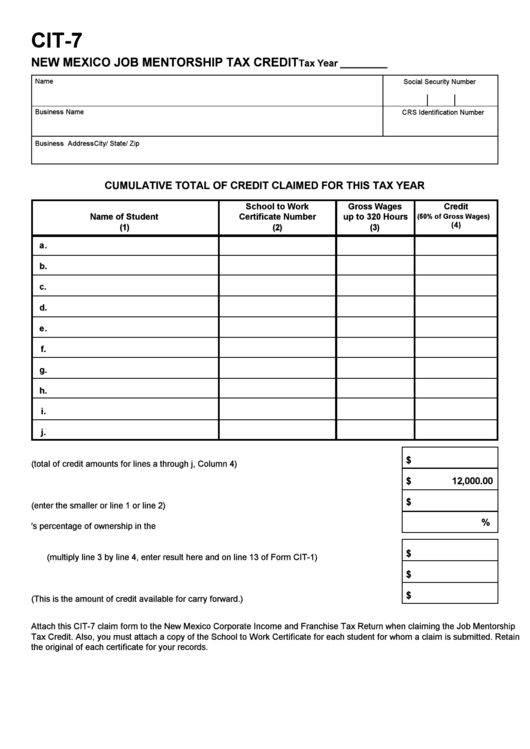

CIT-7

NEW MEXICO JOB MENTORSHIP TAX CREDIT

Tax Year _________

Name

Social Security Number

Business Name

CRS Identification Number

Business Address

City/ State/ Zip

CUMULATIVE TOTAL OF CREDIT CLAIMED FOR THIS TAX YEAR

School to Work

Gross Wages

Credit

Name of Student

Certificate Number

up to 320 Hours

(50% of Gross Wages)

(4)

(1)

(2)

(3)

a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

$

1. Cumulative credit available (total of credit amounts for lines a through j, Column 4) .............. 1

$

12,000.00

2. Maximum credit allowed ...................................................................................................... 2

$

3. Allowable credit (enter the smaller or line 1 or line 2) ........................................................... 3

%

4. Taxpayer's percentage of ownership in the business ............................................................ 4

5. Taxpayers allowable credit

$

(multiply line 3 by line 4, enter result here and on line 13 of Form CIT-1) .............................. 5

$

6. Tax from line 12 of Form CIT-1 ............................................................................................. 6

$

7. Subtract line 6 from line 5. (This is the amount of credit available for carry forward.) ............. 7

Attach this CIT-7 claim form to the New Mexico Corporate Income and Franchise Tax Return when claiming the Job Mentorship

Tax Credit. Also, you must attach a copy of the School to Work Certificate for each student for whom a claim is submitted. Retain

the original of each certificate for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1