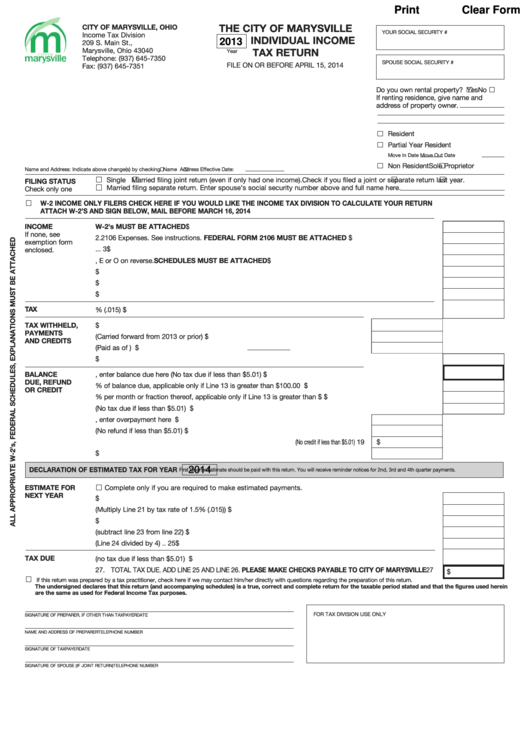

Print

Clear Form

CITY OF MARYSVILLE, OHIO

THE CITY OF MARYSVILLE

YOUR SOCIAL SECURITY #

Income Tax Division

INDIVIDUAL INCOME

2013

209 S. Main St., P.O. Box 385

Marysville, Ohio 43040

Year

TAX RETURN

Telephone: (937) 645-7350

SPOUSE SOCIAL SECURITY #

FILE ON OR BEFORE APRIL 15, 2014

Fax: (937) 645-7351

Do you own rental property?

Yes

No

If renting residence, give name and

address of property owner.

Resident

Partial Year Resident

Move In Date

Move Out Date

Non Resident

Sole Proprietor

Name and Address: Indicate above change(s) by checking

Name

Address Effective Date:

Single

Married filing joint return (even if only had one income). Check if you filed a joint

or separate

return last year.

FILING STATUS

Married filing separate return. Enter spouse’s social security number above and full name here.

Check only one

W-2 INCOME ONLY FILERS CHECK HERE IF YOU WOULD LIKE THE INCOME TAX DIVISION TO CALCULATE YOUR RETURN

ATTACH W-2’S AND SIGN BELOW, MAIL BEFORE MARCH 16, 2014

INCOME

1.

Total W-2 wages. Complete Worksheet A on reverse. W-2's MUST BE ATTACHED .................................... 1

$

If none, see

2.

2106 Expenses. See instructions. FEDERAL FORM 2106 MUST BE ATTACHED ........................................ 2

$

exemption form

3.

TAXABLE WAGES. SUBTRACT LINE 2 FROM LINE 1 ...................................................................................... 3

$

enclosed.

4.

Other income. From Schedule C, E or O on reverse. SCHEDULES MUST BE ATTACHED.......................... 4

$

5.

TOTAL INCOME. ADD LINES 3 AND 4 .............................................................................................................. 5

$

6.

Adjustments. From Schedule X on reverse ........................................................................................................ 6

$

7.

MARYSVILLE TAXABLE INCOME. SUBTRACT LINE 6 FROM LINE 5 ............................................................ 7

$

TAX

8.

MARYSVILLE INCOME TAX. MULTIPLY LINE 7 BY 1.5% (.015) ...................................................................... 8

$

TAX WITHHELD,

9.

Marysville income tax withheld. From W-2 or Worksheet A on Reverse .................. 9

$

PAYMENTS

10. Prior year credits (Carried forward from 2013 or prior) .............................................. 10

$

AND CREDITS

11. Current year estimated payments (Paid as of

) ................................ 11

$

12. TOTAL PAYMENTS AND CREDITS. ADD LINES 9 THROUGH 11 .................................................................. 12

$

13. BALANCE DUE. If line 8 is more than 12, enter balance due here (No tax due if less than $5.01) .............. 13

$

BALANCE

DUE, REFUND

14. Penalty. 10% of balance due, applicable only if Line 13 is greater than $100.00 .......................................... 14

$

OR CREDIT

15. Interest. 2% per month or fraction thereof, applicable only if Line 13 is greater than $100.00 .................... 15

$

16. Total due. Carry to line 25 below (No tax due if less than $5.01) .................................................................... 16

$

17. OVERPAYMENT. If line 8 is less than line 12, enter overpayment here .................... 17

$

18. AMOUNT FROM LINE 17 TO BE REFUNDED (No refund if less than $5.01) .......... 18

$

19. AMOUNT FROM LINE 17 TO BE CREDITED TO NEXT YEAR (No credit if less than $5.01) 19

$

20. AMOUNT FROM LINE 17 TO BE DONATED TO THE CITY ...................................... 20

$

2014

DECLARATION OF ESTIMATED TAX FOR YEAR

First Quarter Estimate should be paid with this return. You will receive reminder notices for 2nd, 3rd and 4th quarter payments.

ESTIMATE FOR

Complete only if you are required to make estimated payments.

NEXT YEAR

21. Total income subject to tax ................................................................................................................................ 21

$

22. Estimated balance due (Multiply Line 21 by tax rate of 1.5% (.015)) .............................................................. 22

$

23. Credit from line 19 above .................................................................................................................................. 23

$

24. Unpaid estimated tax (subtract line 23 from line 22) ........................................................................................ 24

$

25. Amount due with this return 1st quarter payment (Line 24 divided by 4)........................................................ 25

$

TAX DUE

26. Enter balance due from line 16 above (no tax due if less than $5.01) ............................................................ 26

$

27. TOTAL TAX DUE. ADD LINE 25 AND LINE 26. PLEASE MAKE CHECKS PAYABLE TO CITY OF MARYSVILLE 27

$

If this return was prepared by a tax practitioner, check here if we may contact him/her directly with questions regarding the preparation of this return.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein

are the same as used for Federal Income Tax purposes.

FOR TAX DIVISION USE ONLY

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER

DATE

NAME AND ADDRESS OF PREPARER

TELEPHONE NUMBER

SIGNATURE OF TAXPAYER

DATE

SIGNATURE OF SPOUSE (IF JOINT RETURN)

TELEPHONE NUMBER

1

1 2

2 3

3