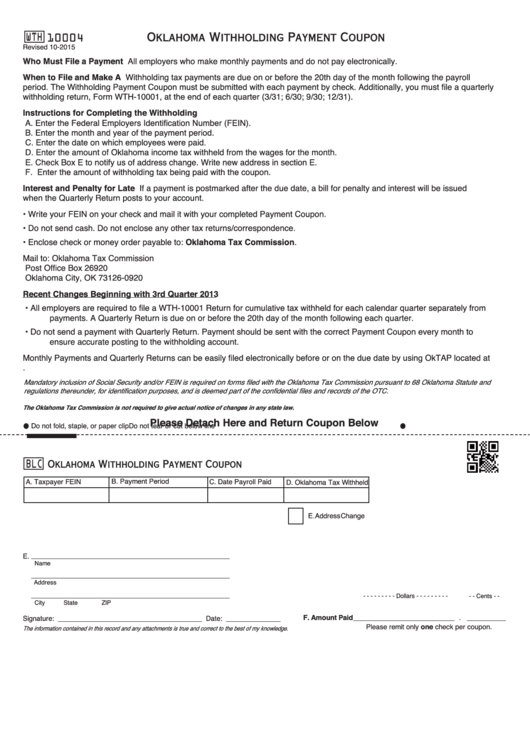

Oklahoma Withholding Payment Coupon

WTH

10004

Revised 10-2015

Who Must File a Payment Coupon...All employers who make monthly payments and do not pay electronically.

When to File and Make A Payment...Withholding tax payments are due on or before the 20th day of the month following the payroll

period. The Withholding Payment Coupon must be submitted with each payment by check. Additionally, you must file a quarterly

withholding return, Form WTH-10001, at the end of each quarter (3/31; 6/30; 9/30; 12/31).

Instructions for Completing the Withholding Coupon...

A. Enter the Federal Employers Identification Number (FEIN).

B. Enter the month and year of the payment period.

C. Enter the date on which employees were paid.

D. Enter the amount of Oklahoma income tax withheld from the wages for the month.

E. Check Box E to notify us of address change. Write new address in section E.

F. Enter the amount of withholding tax being paid with the coupon.

Interest and Penalty for Late Payments...If a payment is postmarked after the due date, a bill for penalty and interest will be issued

when the Quarterly Return posts to your account.

• Write your FEIN on your check and mail it with your completed Payment Coupon.

• Do not send cash. Do not enclose any other tax returns/correspondence.

• Enclose check or money order payable to: Oklahoma Tax Commission.

Mail to: Oklahoma Tax Commission

Post Office Box 26920

Oklahoma City, OK 73126-0920

Recent Changes Beginning with 3rd Quarter 2013

• All employers are required to file a WTH-10001 Return for cumulative tax withheld for each calendar quarter separately from

payments. A Quarterly Return is due on or before the 20th day of the month following each quarter.

• Do not send a payment with Quarterly Return. Payment should be sent with the correct Payment Coupon every month to

ensure accurate posting to the withholding account.

Monthly Payments and Quarterly Returns can be easily filed electronically before or on the due date by using OkTAP located at

Mandatory inclusion of Social Security and/or FEIN is required on forms filed with the Oklahoma Tax Commission pursuant to 68 Oklahoma Statute and

regulations thereunder, for identification purposes, and is deemed part of the confidential files and records of the OTC.

The Oklahoma Tax Commission is not required to give actual notice of changes in any state law.

Please Detach Here and Return Coupon Below

Do not fold, staple, or paper clip

Do not tear or cut below line

Oklahoma Withholding Payment Coupon

BLC

A. Taxpayer FEIN

B. Payment Period

C. Date Payroll Paid

D. Oklahoma Tax Withheld

E. Address Change

___________________________________________________

E.

Name

___________________________________________________

Address

___________________________________________________

- - - - - - - - - Dollars - - - - - - - - -

- - Cents - -

City

State

ZIP

F. Amount Paid __________________________ . __________

Signature: _____________________________________

Date: ______________

Please remit only one check per coupon.

The information contained in this record and any attachments is true and correct to the best of my knowledge.

1

1