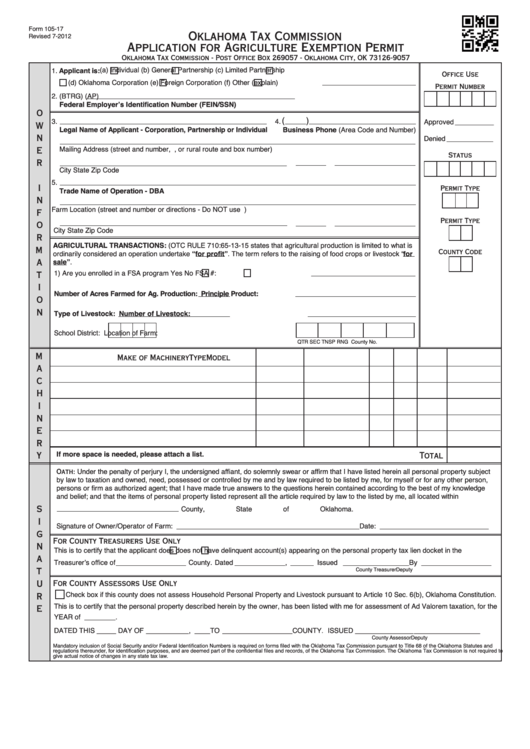

Form 105-17

Oklahoma Tax Commission

Revised 7-2012

Application for Agriculture Exemption Permit

Oklahoma Tax Commission - Post Office Box 269057 - Oklahoma City, OK 73126-9057

(a) Individual

(b) General Partnership

(c) Limited Partnership

1. Applicant is:

Office Use

(d) Oklahoma Corporation

(e) Foreign Corporation

(f) Other (explain)

Permit Number

2. (BTRG)

(AP)

Federal Employer’s Identification Number (FEIN/SSN)

o

(

)

3.

4.

Approved __________

w

Legal Name of Applicant - Corporation, Partnership or Individual

Business Phone (Area Code and Number)

n

Denied ____________

e

Mailing Address (street and number, P.O. Box, or rural route and box number)

Status

r

City

State

Zip Code

5.

i

Permit Type

Trade Name of Operation - DBA

n

Farm Location (street and number or directions - Do NOT use P.O. Box or rural route number)

f

Permit Type

o

City

State

Zip Code

r

AGRICULTURAL TRANSACTIONS: (OTC RULE 710:65-13-15 states that agricultural production is limited to what is

m

County Code

ordinarily considered an operation undertake “for profit”. The term refers to the raising of food crops or livestock “for

a

sale”.

1) Are you enrolled in a FSA program

Yes

No

FSA #:

t

i

Number of Acres Farmed for Ag. Production:

Principle Product:

o

n

Type of Livestock:

Number of Livestock:

School District:

Location of Farm:

QTR

SEC

TNSP

RNG

County No.

m

Make of Machinery

Type

Model Number

Year H.P.

Fuel

Value

a

c

h

i

n

e

r

y

If more space is needed, please attach a list.

Total

Oath: Under the penalty of perjury I, the undersigned affiant, do solemnly swear or affirm that I have listed herein all personal property subject

by law to taxation and owned, need, possessed or controlled by me and by law required to be listed by me, for myself or for any other person,

persons or firm as authorized agent; that I have made true answers to the questions herein contained according to the best of my knowledge

and belief; and that the items of personal property listed represent all the article required by law to the listed by me, all located within

s

County, State of Oklahoma.

i

Signature of Owner/Operator of Farm: _______________________________________________ Date: ____________________________

g

For County Treasurers Use Only

n

This is to certify that the applicant

does

does not have delinquent account(s) appearing on the personal property tax lien docket in the

a

Treasurer’s office of __________________ County. Dated _____________ , ______ Issued _________________ By __________________

t

County Treasurer

Deputy

u

For County Assessors Use Only

r

Check box if this county does not assess Household Personal Property and Livestock pursuant to Article 10 Sec. 6(b), Oklahoma Constitution.

This is to certify that the personal property described herein by the owner, has been listed with me for assessment of Ad Valorem taxation, for the

e

YEAR of ________ .

DATED THIS _____ DAY OF ___________ , ____ TO __________________ COUNTY. ISSUED _______________

_________________

County Assessor

Deputy

Mandatory inclusion of Social Security and/or Federal Identification Numbers is required on forms filed with the Oklahoma Tax Commission pursuant to Title 68 of the Oklahoma Statutes and

regulations thereunder, for identification purposes, and are deemed part of the confidential files and records, of the Oklahoma Tax Commission. The Oklahoma Tax Commission is not required to

give actual notice of changes in any state tax law.

1

1 2

2