Form De 88all-I - Change Of Address/address Correction And Final Report Form

ADVERTISEMENT

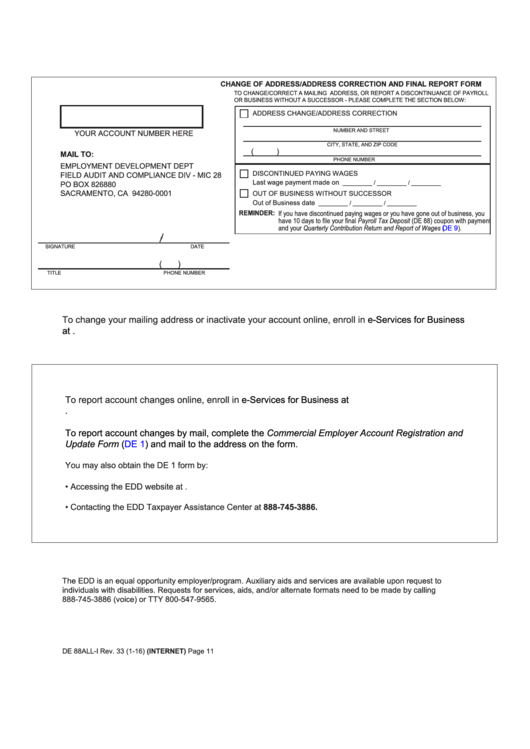

CHANGE OF ADDRESS/ADDRESS CORRECTION AND FINAL REPORT FORM

TO CHANGE/CORRECT A MAILING ADDRESS, OR REPORT A DISCONTINUANCE OF PAYROLL

OR BUSINESS WITHOUT A SUCCESSOR - PLEASE COMPLETE THE SECTION BELOW:

ADDRESS CHANGE/ADDRESS CORRECTION

NUMBER AND STREET

YOUR ACCOUNT NUMBER HERE

CITY, STATE, AND ZIP CODE

(

)

MAIL TO:

PHONE NUMBER

EMPLOYMENT DEVELOPMENT DEPT

DISCONTINUED PAYING WAGES

FIELD AUDIT AND COMPLIANCE DIV - MIC 28

Last wage payment made on

PO BOX 826880

_________ / _________ / _________

SACRAMENTO, CA 94280-0001

OUT OF BUSINESS WITHOUT SUCCESSOR

Out of Business date

_________ / _________ / _________

REMINDER:

If you have discontinued paying wages or you have gone out of business, you

have 10 days to file your final Payroll Tax Deposit (DE 88) coupon with payment

and your Quarterly Contribution Return and Report of Wages

(DE

9).

SIGNATURE

DATE

(

)

TITLE

PHONE NUMBER

To change your mailing address or inactivate your account online, enroll in

e-Services for Business

at

To report account changes online, enroll in

e-Services for Business at

To report account changes by mail, complete the Commercial Employer Account Registration and

(DE

1) and mail to the address on the form.

Update Form

You may also obtain the DE 1 form by:

Accessing the EDD website at

•

•

Contacting the EDD Taxpayer Assistance Center at 888-745-3886.

The EDD is an equal opportunity employer/program. Auxiliary aids and services are available upon request to

individuals with disabilities. Requests for services, aids, and/or alternate formats need to be made by calling

888-745-3886 (voice) or TTY 800-547-9565.

DE 88ALL-I Rev. 33 (1-16) (INTERNET)

Page 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1