Form D-40es - Change Of Address, Worksheet And Amended Computation Schedule - 2001

ADVERTISEMENT

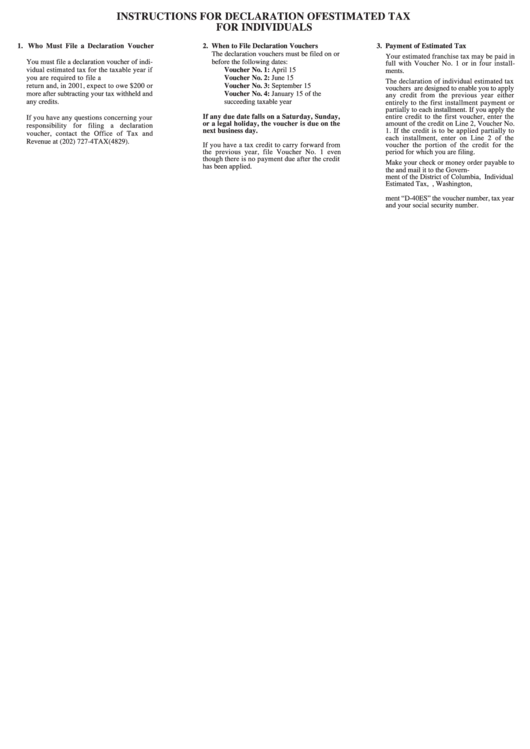

INSTRUCTIONS FOR DECLARATION OF ESTIMATED TAX

FOR INDIVIDUALS

1. Who Must File a Declaration Voucher

2. When to File Declaration Vouchers

3. Payment of Estimated Tax

The declaration vouchers must be filed on or

Your estimated franchise tax may be paid in

You must file a declaration voucher of indi-

before the following dates:

full with Voucher No. 1 or in four install-

vidual estimated tax for the taxable year if

Voucher No. 1: April 15

ments.

you are required to file a D.C. income tax

Voucher No. 2: June 15

The declaration of individual estimated tax

return and, in 2001, expect to owe $200 or

Voucher No. 3: September 15

vouchers are designed to enable you to apply

more after subtracting your tax withheld and

Voucher No. 4: January 15 of the

any credit from the previous year either

any credits.

succeeding taxable year

entirely to the first installment payment or

partially to each installment. If you apply the

entire credit to the first voucher, enter the

If any due date falls on a Saturday, Sunday,

If you have any questions concerning your

amount of the credit on Line 2, Voucher No.

or a legal holiday, the voucher is due on the

responsibility for filing a declaration

1. If the credit is to be applied partially to

next business day.

voucher, contact the Office of Tax and

each installment, enter on Line 2 of the

Revenue at (202) 727-4TAX(4829).

If you have a tax credit to carry forward from

voucher the portion of the credit for the

the previous year, file Voucher No. 1 even

period for which you are filing.

though there is no payment due after the credit

Make your check or money order payable to

has been applied.

the D.C. Treasurer and mail it to the Govern-

ment of the District of Columbia, Individual

Estimated Tax, P.O. Box 96018, Washington,

D.C. 20090-6018. Please write on the pay-

ment “D-40ES” the voucher number, tax year

and your social security number.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7