Form De 88all-I - Change Of Address / Address Correction And Final Report Form - Employment Development Dept

ADVERTISEMENT

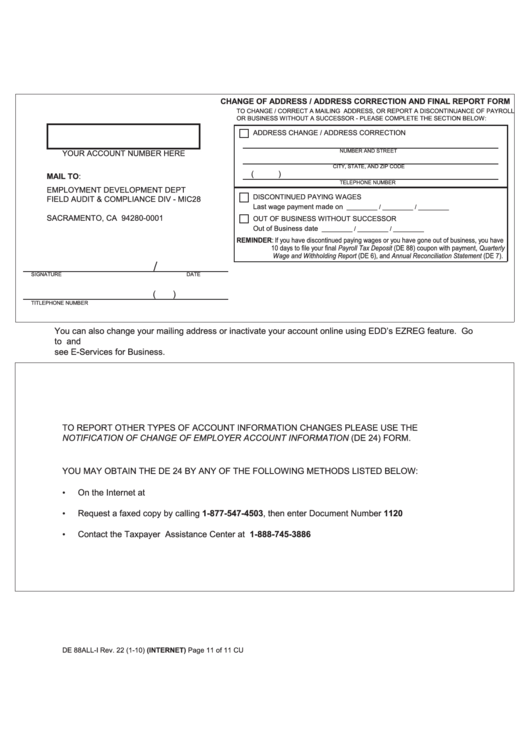

CHANGE OF ADDRESS / ADDRESS CORRECTION AND FINAL REPORT FORM

TO CHANGE / CORRECT A MAILING ADDRESS, OR REPORT A DISCONTINUANCE OF PAYROLL

OR BUSINESS WITHOUT A SUCCESSOR - PLEASE COMPLETE THE SECTION BELOW:

ADDRESS CHANGE / ADDRESS CORRECTION

NUMBER AND STREET

YOUR ACCOUNT NUMBER HERE

CITY, STATE, AND ZIP CODE

(

)

MAIL TO:

TELEPHONE NUMBER

EMPLOYMENT DEVELOPMENT DEPT

DISCONTINUED PAYING WAGES

FIELD AUDIT & COMPLIANCE DIV - MIC28

Last wage payment made on

P.O. BOX 826880

_________ / _________ / _________

SACRAMENTO, CA 94280-0001

OUT OF BUSINESS WITHOUT SUCCESSOR

Out of Business date

_________ / _________ / _________

REMINDER: If you have discontinued paying wages or you have gone out of business, you have

10 days to file your final Payroll Tax Deposit (DE 88) coupon with payment, Quarterly

Wage and Withholding Report (DE 6), and Annual Reconciliation Statement (DE 7).

SIGNATURE

DATE

(

)

TITLE

PHONE NUMBER

You can also change your mailing address or inactivate your account online using EDD’s EZREG feature. Go

to and

see E-Services for Business.

TO REPORT OTHER TYPES OF ACCOUNT INFORMATION CHANGES PLEASE USE THE

NOTIFICATION OF CHANGE OF EMPLOYER ACCOUNT INFORMATION (DE 24) FORM.

YOU MAY OBTAIN THE DE 24 BY ANY OF THE FOLLOWING METHODS LISTED BELOW:

•

On the Internet at

•

Request a faxed copy by calling 1-877-547-4503, then enter Document Number 1120

•

Contact the Taxpayer Assistance Center at 1-888-745-3886

DE 88ALL-I Rev. 22 (1-10) (INTERNET)

Page 11 of 11

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1