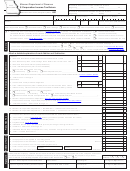

Form Mo-1120s - S Corporation Income/franchise Tax Return - 2000

ADVERTISEMENT

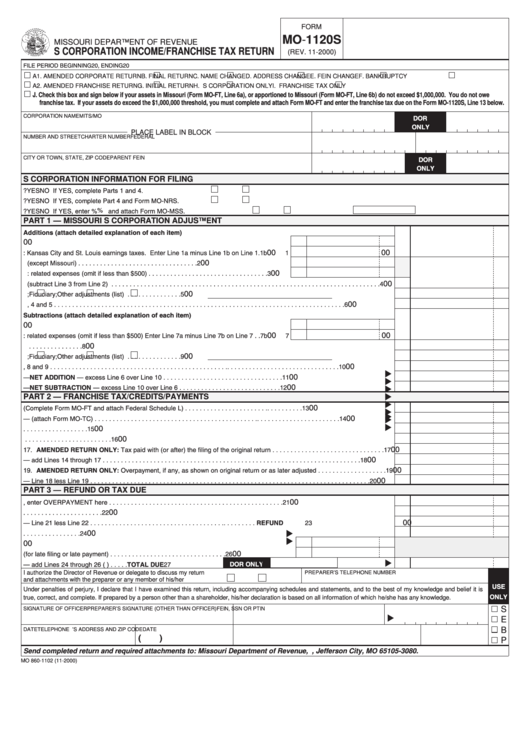

FORM

MO-1120S

MISSOURI DEPARTMENT OF REVENUE

S CORPORATION INCOME/FRANCHISE TAX RETURN

(REV. 11-2000)

FILE PERIOD BEGINNING

20

, ENDING

20

A1. AMENDED CORPORATE RETURN

B. FINAL RETURN

C. NAME CHANGE

D. ADDRESS CHANGE

E. FEIN CHANGE

F. BANKRUPTCY

A2. AMENDED FRANCHISE RETURN

G. INITIAL RETURN

H. S CORPORATION ONLY

I. FRANCHISE TAX ONLY

J. Check this box and sign below if your assets in Missouri (Form MO-FT, Line 6a), or apportioned to Missouri (Form MO-FT, Line 6b) do not exceed $1,000,000. You do not owe

franchise tax. If your assets do exceed the $1,000,000 threshold, you must complete and attach Form MO-FT and enter the franchise tax due on the Form MO-1120S, Line 13 below.

CORPORATION NAME

MITS/MO I.D. NUMBER

DOR

ONLY

PLACE LABEL IN BLOCK

NUMBER AND STREET

CHARTER NUMBER

FEDERAL I.D. NUMBER

CITY OR TOWN, STATE, ZIP CODE

PARENT FEIN

DOR

ONLY

S CORPORATION INFORMATION FOR FILING

1. Does the S corporation have ANY Missouri modifications?

YES

NO If YES, complete Parts 1 and 4.

2. Does the S corporation have ANY nonresident shareholders?

YES

NO If YES, complete Part 4 and Form MO-NRS.

% and attach Form MO-MSS.

3. Does S corporation have income derived from sources other than Missouri?

YES

NO If YES, enter %

PART 1 — MISSOURI S CORPORATION ADJUSTMENT

Additions (attach detailed explanation of each item)

00

1a. State and local income taxes deducted on Federal Form 1120S . . . . . . . . . . . . . . . . . . .

1a

00

00

1b. Less: Kansas City and St. Louis earnings taxes. Enter Line 1a minus Line 1b on Line 1.

1b

1

00

2. State and local bond interest (except Missouri) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3. Less: related expenses (omit if less than $500) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4. Net (subtract Line 3 from Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5.

Partnership;

Fiduciary;

Other adjustments (list

) . . . . . . . . . . . . . . .

5

00

6. Total of Lines 1, 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Subtractions (attach detailed explanation of each item)

00

7a. Interest from exempt federal obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

00

00

7b. Less: related expenses (omit if less than $500) Enter Line 7a minus Line 7b on Line 7 . .

7b

7

00

8. Amount of any state income tax refund included in federal ordinary income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9.

Partnership;

Fiduciary;

Other adjustments (list

) . . . . . . . . . . . . . . .

9

00

10. Total of Lines 7, 8 and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11. Missouri S corporation adjustment — NET ADDITION — excess Line 6 over Line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

12. Missouri S corporation adjustment — NET SUBTRACTION — excess Line 10 over Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

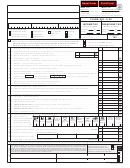

PART 2 — FRANCHISE TAX/CREDITS/PAYMENTS

00

13. Corporation Franchise Tax (Complete Form MO-FT and attach Federal Schedule L) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

14. Tax credits — (attach Form MO-TC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

15. Include approved overpayments applied from last file period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

16. Payments with Form MO-60 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

00

17. AMENDED RETURN ONLY: Tax paid with (or after) the filing of the original return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

00

18. Subtotal — add Lines 14 through 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

00

19. AMENDED RETURN ONLY: Overpayment, if any, as shown on original return or as later adjusted . . . . . . . . . . . . . . . . . . .

19

00

20. Total — Line 18 less Line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

PART 3 — REFUND OR TAX DUE

00

21. If Line 20 is greater than Line 13, enter OVERPAYMENT here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22. Overpayment to be applied to next filing period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23. Overpayment to be refunded — Line 21 less Line 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . REFUND

23

00

24. If Line 20 is less than Line 13 enter UNDERPAYMENT here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

00

25. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

00

26. Additions to tax (for late filing or late payment) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

DOR ONLY

27. TOTAL DUE — add Lines 24 through 26 (U.S. funds only) . . . . .

TOTAL DUE

27

I authorize the Director of Revenue or delegate to discuss my return

PREPARER’S TELEPHONE NUMBER

DOR

and attachments with the preparer or any member of his/her firm.

YES

NO

USE

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is

ONLY

true, correct, and complete. If prepared by a person other than a shareholder, his/her declaration is based on all information of which he/she has any knowledge.

S

SIGNATURE OF OFFICER

PREPARER’S SIGNATURE (OTHER THAN OFFICER)

FEIN, SSN OR PTIN

E

B

DATE

TELEPHONE NO.

PREPARER’S ADDRESS AND ZIP CODE

DATE

(

)

P

Send completed return and required attachments to: Missouri Department of Revenue, P.O. Box 3080, Jefferson City, MO 65105-3080.

MO 860-1102 (11-2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2