Instructions For Form 941-Ss - Employer'S Quarterly Federal Tax Returnamerican Samoa, Guam, The Commonwealth Of The Northern Mariana Islands, And The U.s. Virgin Islands - 2003

ADVERTISEMENT

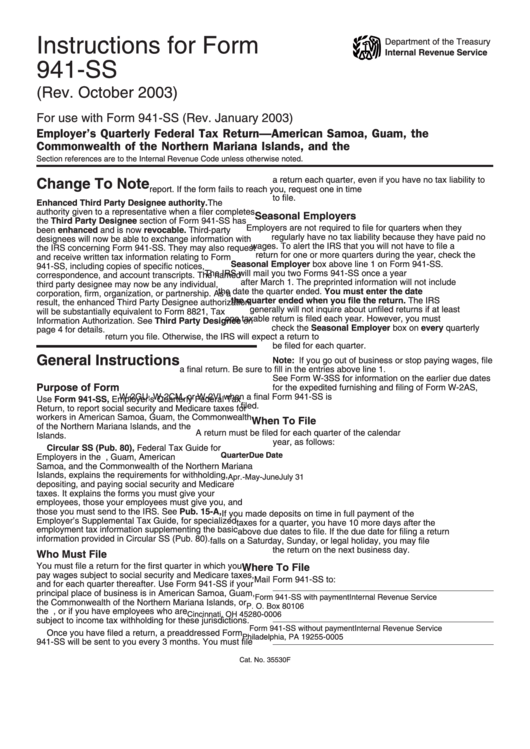

Instructions for Form

Department of the Treasury

Internal Revenue Service

941-SS

(Rev. October 2003)

For use with Form 941-SS (Rev. January 2003)

Employer’s Quarterly Federal Tax Return—American Samoa, Guam, the

Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

Section references are to the Internal Revenue Code unless otherwise noted.

a return each quarter, even if you have no tax liability to

Change To Note

report. If the form fails to reach you, request one in time

to file.

Enhanced Third Party Designee authority. The

authority given to a representative when a filer completes

Seasonal Employers

the Third Party Designee section of Form 941-SS has

Employers are not required to file for quarters when they

been enhanced and is now revocable. Third-party

regularly have no tax liability because they have paid no

designees will now be able to exchange information with

wages. To alert the IRS that you will not have to file a

the IRS concerning Form 941-SS. They may also request

return for one or more quarters during the year, check the

and receive written tax information relating to Form

Seasonal Employer box above line 1 on Form 941-SS.

941-SS, including copies of specific notices,

The IRS will mail you two Forms 941-SS once a year

correspondence, and account transcripts. The named

after March 1. The preprinted information will not include

third party designee may now be any individual,

the date the quarter ended. You must enter the date

corporation, firm, organization, or partnership. As a

the quarter ended when you file the return. The IRS

result, the enhanced Third Party Designee authorization

generally will not inquire about unfiled returns if at least

will be substantially equivalent to Form 8821, Tax

one taxable return is filed each year. However, you must

Information Authorization. See Third Party Designee on

check the Seasonal Employer box on every quarterly

page 4 for details.

return you file. Otherwise, the IRS will expect a return to

be filed for each quarter.

General Instructions

Note: If you go out of business or stop paying wages, file

a final return. Be sure to fill in the entries above line 1.

See Form W-3SS for information on the earlier due dates

Purpose of Form

for the expedited furnishing and filing of Form W-2AS,

W-2GU, W-2CM, or W-2VI when a final Form 941-SS is

Use Form 941-SS, Employer’s Quarterly Federal Tax

filed.

Return, to report social security and Medicare taxes for

workers in American Samoa, Guam, the Commonwealth

When To File

of the Northern Mariana Islands, and the U.S. Virgin

A return must be filed for each quarter of the calendar

Islands.

year, as follows:

Circular SS (Pub. 80), Federal Tax Guide for

Quarter

Due Date

Employers in the U.S. Virgin Islands, Guam, American

Samoa, and the Commonwealth of the Northern Mariana

Jan.-Feb.-Mar.

April 30

Islands, explains the requirements for withholding,

Apr.-May-June

July 31

depositing, and paying social security and Medicare

July-Aug.-Sept.

Oct. 31

taxes. It explains the forms you must give your

Oct.-Nov.-Dec.

Jan. 31

employees, those your employees must give you, and

those you must send to the IRS. See Pub. 15-A,

If you made deposits on time in full payment of the

Employer’s Supplemental Tax Guide, for specialized

taxes for a quarter, you have 10 more days after the

employment tax information supplementing the basic

above due dates to file. If the due date for filing a return

information provided in Circular SS (Pub. 80).

falls on a Saturday, Sunday, or legal holiday, you may file

the return on the next business day.

Who Must File

You must file a return for the first quarter in which you

Where To File

pay wages subject to social security and Medicare taxes,

Mail Form 941-SS to:

and for each quarter thereafter. Use Form 941-SS if your

principal place of business is in American Samoa, Guam,

Form 941-SS with payment

Internal Revenue Service

the Commonwealth of the Northern Mariana Islands, or

P. O. Box 80106

the U.S. Virgin Islands, or if you have employees who are

Cincinnati, OH 45280-0006

subject to income tax withholding for these jurisdictions.

Form 941-SS without payment Internal Revenue Service

Once you have filed a return, a preaddressed Form

Philadelphia, PA 19255-0005

941-SS will be sent to you every 3 months. You must file

Cat. No. 35530F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4