Income Tax Return - 2004 - City Of Canton, Ohio

ADVERTISEMENT

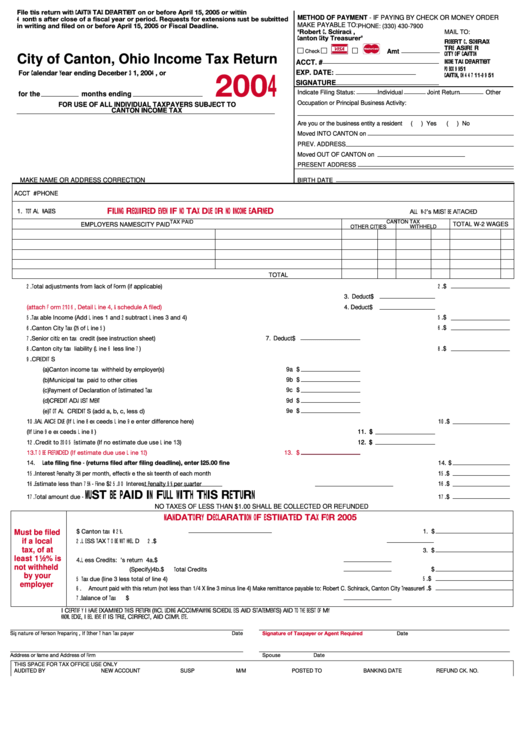

File th is return with C AN TO N TAX DE P ARTM E N T on or before April 15, 2005 or with in

METHOD OF PAYMENT - IF PAYING BY CHECK OR MONEY ORDER

4 m onth s after close of a fiscal year or period. Requests for extensions m ust be subm itted

MAKE PAYABLE TO:

in writing and filed on or before April 15, 2005 or Fiscal Deadline.

PHONE: (330) 430-7900

“ Robert C . Sch irack ,

MAIL TO:

C anton C ity Treasurer”

RO B E RT C . SC H IRAC K

TRE ASU RE R

®

Amt

Check

City of Canton, Ohio Income Tax Return

C ITY O F C AN TO N

ACCT. #

IN C O M E TAX DE P ARTM E N T

P O B O X 9 9 51

EXP. DATE:

For C alendar Y ear ending Decem ber 3 1, 2004 , or

2004

C AN TO N , O H 4 4 7 11- 9 9 51

SIGNATURE

Indicate Filing Status:

Individual

Joint Return

Other

for the

months ending

Occupation or Principal Business Activity:

FOR USE OF ALL INDIVIDUAL TAXPAYERS SUBJECT TO

CANTON INCOME TAX

Are you or the business entity a resident

(

) Yes

(

) No

Moved INTO CANTON on

PREV. ADDRESS

Moved OUT OF CANTON on

PRESENT ADDRESS

MAKE NAME OR ADDRESS CORRECTION

BIRTH DATE

ACCT NO.

Your Social Security No.

SPOUSE SS#

PHONE

FIL IN G RE Q U IRE D E V E N IF N O TAX DU E O R N O IN C O M E E ARN E D

1. T O T AL W AG E S

AL L W - 2 ’s MU ST B E AT T ACH E D

TAX PAID

CANTON TAX

EMPLOYERS NAMES

CITY PAID

TOTAL W-2 WAGES

OTHER CITIES

WITHHELD

TOTAL

2 .

T otal adjustments from B ack of F orm (if applicable)

2 . $

3. Deduct $

3.

W ag es earned outside Canton by part year non- resident or prior to 18 th birthday

4. Deduct $

4.

Allowable E mployee B usiness E x pense

(attach F orm 2 10 6 , Detail L ine 4, & schedule A filed)

5 .

T ax able Income (Add L ines 1 and 2 subtract L ines 3 and 4)

5 . $

6 .

Canton City T ax (2 % of L ine 5 )

6 . $

7. Deduct $

7 .

Senior citiz en tax credit (see instruction sheet)

8 .

Canton city tax liability (L ine 6 less line 7 )

8 . $

9 .

CRE DIT S

9a $

(a) Canton income tax withheld by employer(s)

9b $

(b) Municipal tax paid to other cities

9c $

(c) P ayment of Declaration of E stimated T ax

9d $

(d) CRE DIT ADJ U ST ME N T

9e $

(e) T O T AL CRE DIT S (add a, b, c, less d)

10 . $

10 .

B AL AN CE DU E (If L ine 8 ex ceeds L ine 9 e enter difference here)

11. $

11. $

11.

O v erpayment claimed (If L ine 9 e ex ceeds L ine 8 )

12. $

12. $

12 .

Credit to 2 0 0 5 E stimate (If no estimate due use L ine 13)

13. $

13.

T O B E RE F U N DE D (If estimate due use L ine 12 )

14.

L ate filing fine - (returns filed after filing deadline), enter $ 25.00 fine

14. $

15 .

Interest P enalty 3% per month, effectiv e the six teenth of each month

15 . $

16 .

E stimate less than 7 5 % - F ine $2 5 .0 0

Interest P enalty 9 % per q uarter

16 . $

M U ST B E P AID IN FU L L W ITH TH IS RE TU RN

17 . $

17 .

T otal amount due -

NO TAXES OF LESS THAN $1.00 SHALL BE COLLECTED OR REFUNDED

M AN DATO RY DE C L ARATIO N O F E STIM ATE D TAX FO R 2005

Must be filed

1.

T otal income subject to Canton tax $

Canton tax @ 2 % .

1. $

if a local

2 .

L E SS T AX T O B E W IT H H E L D

2 . $

tax, of at

3.

B alance estimated Canton tax

3. $

least 12 % is

4.

L ess Credits: a.

O v erpayment on prev ious year’s return

4a. $

not withheld

b.

O ther (Specify)

4b. $

T otal Credits

$

by your

5 .

N et T ax due (line 3 less total of line 4)

5 . $

employer

6 .

Amount paid with this return (not less than 1/4 X line 3 minus line 4) Make remittance payable to: Robert C. Schirack, Canton City T reasurer

6 . $

7 .

B alance of T ax

$

I CE RT IF Y I H AV E E XAMIN E D T H IS RE T U RN (IN CL U DIN G ACCO MP AN Y IN G SCH E DU L E S AN D ST AT E ME N T S) AN D T O T H E B E ST O F MY

K N O W L E DG E , I B E L IE V E IT IS T RU E , CO RRE CT , AN D CO MP L E T E .

Sig nature of P erson P reparing , If O ther T han T ax payer

Date

Signature of Taxpayer or Agent Required

Date

Address or N ame and Address of F irm

Spouse

Date

THIS SPACE FOR TAX OFFICE USE ONLY

AUDITED BY

NEW ACCOUNT

SUSP

M/M

POSTED TO

BANKING DATE

REFUND CK. NO.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3