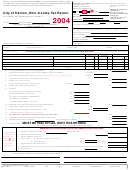

Income Tax Return - 2004 - City Of Canton, Ohio Page 3

ADVERTISEMENT

TY 2004

PASSIVE

RECONCILIATION WITH FEDERAL INCOME TAX RETURN - Attach Schedules

SCHEDULE X

ADD

DEDUCT

ITEMS NOT DEDUCTIBLE

$

$

a. Capital Losses - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

p. Capital gains (Excluding Ordinary Gains From 4797) - -

b. Expenses incurred in the production of non-taxable

q. Interest income - - - - - - - - - - - - - - - - - - - - - - - - - - - -

income (At least 5% of Line t) - - - - - - - - - - - - - - - - -

c. Taxes based on income - - - - - - - - - - - - - - - - - - - - - -

r. Dividends - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

d. Payments to partners - - - - - - - - - - - - - - - - - - - - - - - -

s. Other (Explain) - - - - - - - - - - - - - - - - - - - - - - - - - - - -

e. Sick pay/3rd party insurance payment - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

f. Other (Explain) - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

$

g. Total Additions - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

$

t. Total Deductions - - - - - - - - - - - - - - - - - - - - - - - - - - - -

NET ADJUSTMENTS (g-t)

SCHEDULE Y BUSINESS ALLOCATION FORMULA

a. LOCATED

b. LOCATED IN

c. PERCENTAGE

. .

EVERYWHERE

THIS MUNICIPALITY

(b a)

AVG. VALUE OF REAL & TANG. PERSONAL PROPERTY.

STEP 1.

GROSS ANNUAL RENTALS PAID MULTIPLIED BY 8

TOTAL STEP 1.

%

GROSS RECEIPTS FROM SALES MADE AND/OR WORK

STEP 2.

OR SERVICES PERFORMED (SEE INSTRUCTIONS).

%

WAGES, SALARIES, AND OTHER COMPENSATION PAID.

STEP 3.

%

TOTAL PERCENTAGES.

STEP

4.

%

STEP

5.

AVERAGE PERCENTAGE (Divide Total Percentages by number of percentages used. A factor is applicable

even though it may be allocable entirely in or outside THE CITY OF CANTON).

%

NON-PASSIVE

RECONCILIATION WITH FEDERAL INCOME TAX RETURN - Attach Schedules

SCHEDULE X

ADD

DEDUCT

ITEMS NOT DEDUCTIBLE

ITEMS NOT TAXABLE

$

$

a. Capital Losses - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

p. Capital gains (Excluding Ordinary Gains From 4797) - -

b. Expenses incurred in the production of non-taxable

q. Interest income - - - - - - - - - - - - - - - - - - - - - - - - - - - -

income (At least 5% of Line t) - - - - - - - - - - - - - - - - -

c. Taxes based on income - - - - - - - - - - - - - - - - - - - - - -

r. Dividends - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

d. Payments to partners - - - - - - - - - - - - - - - - - - - - - - - -

s. Other (Explain) - - - - - - - - - - - - - - - - - - - - - - - - - - - -

e. Sick pay/3rd party insurance payment - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

f. Other (Explain) - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

$

g. Total Additions - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

$

t. Total Deductions - - - - - - - - - - - - - - - - - - - - - - - - - - - -

NET ADJUSTMENTS (g-t)

SCHEDULE Y BUSINESS ALLOCATION FORMULA

a. LOCATED

b. LOCATED IN

c. PERCENTAGE

. .

EVERYWHERE

THIS MUNICIPALITY

(b a)

STEP 1. AVG. VALUE OF REAL & TANG. PERSONAL PROPERTY.

GROSS ANNUAL RENTALS PAID MULTIPLIED BY 8

TOTAL STEP 1.

%

STEP 2.

GROSS RECEIPTS FROM SALES MADE AND/OR WORK

OR SERVICES PERFORMED (SEE INSTRUCTIONS).

%

STEP 3.

WAGES, SALARIES, AND OTHER COMPENSATION PAID.

%

STEP

4.

TOTAL PERCENTAGES.

%

STEP

5.

AVERAGE PERCENTAGE (Divide Total Percentages by number of percentages used. A factor is applicable

even though it may be allocable entirely in or outside THE CITY OF CANTON).

%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3