Form Il-501 - Payment Coupon And Instructions

ADVERTISEMENT

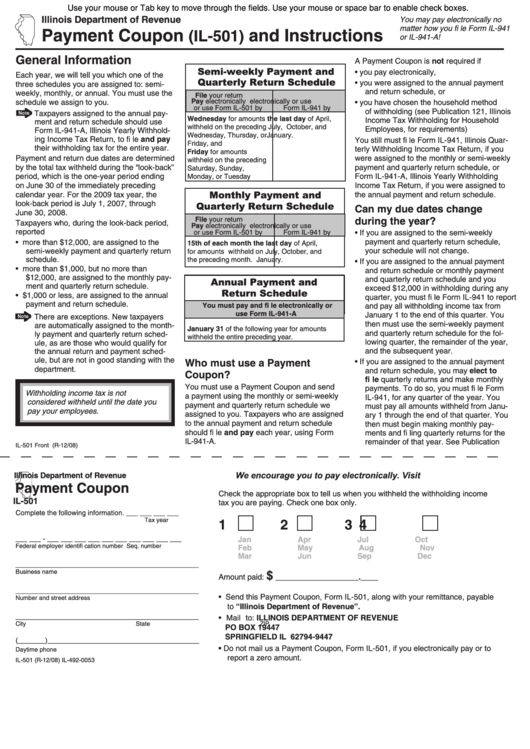

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

You may pay electronically no

matter how you fi le Form IL-941

Payment Coupon

and Instructions

(IL-501)

or IL-941-A!

General Information

A Payment Coupon is not required if

Semi-weekly Payment and

• you pay electronically,

Each year, we will tell you which one of the

Quarterly Return Schedule

• you were assigned to the annual payment

three schedules you are assigned to: semi-

and return schedule, or

weekly, monthly, or annual. You must use the

File your return

Pay electronically

electronically or use

schedule we assign to you.

• you have chosen the household method

or use Form IL-501 by

Form IL-941 by

of withholding (see Publication 121, Illinois

Taxpayers assigned to the annual pay-

Wednesday for amounts

the last day of April,

Income Tax Withholding for Household

ment and return schedule should use

withheld on the preceding

July, October, and

Employees, for requirements)

Form IL-941-A, Illinois Yearly Withhold-

Wednesday, Thursday, or

January.

ing Income Tax Return, to fi le and pay

You still must fi le Form IL-941, Illinois Quar-

Friday, and

their withholding tax for the entire year.

terly Withholding Income Tax Return, if you

Friday for amounts

Payment and return due dates are determined

were assigned to the monthly or semi-weekly

withheld on the preceding

by the total tax withheld during the “look-back”

payment and quarterly return schedule, or

Saturday, Sunday,

period, which is the one-year period ending

Form IL-941-A, Illinois Yearly Withholding

Monday, or Tuesday

on June 30 of the immediately preceding

Income Tax Return, if you were assigned to

Monthly Payment and

calendar year. For the 2009 tax year, the

the annual payment and return schedule.

Quarterly Return Schedule

look-back period is July 1, 2007, through

Can my due dates change

June 30, 2008.

File your return

during the year?

Taxpayers who, during the look-back period,

Pay electronically

electronically or use

reported

or use Form IL-501 by

Form IL-941 by

• If you are assigned to the semi-weekly

• more than $12,000, are assigned to the

payment and quarterly return schedule,

15th of each month

the last day of April,

semi-weekly payment and quarterly return

your schedule will not change.

for amounts withheld on

July, October, and

schedule.

the preceding month.

January.

• If you are assigned to the annual payment

• more than $1,000, but no more than

and return schedule or monthly payment

$12,000, are assigned to the monthly pay-

Annual Payment and

and quarterly return schedule and you

ment and quarterly return schedule.

exceed $12,000 in withholding during any

Return Schedule

• $1,000 or less, are assigned to the annual

quarter, you must fi le Form IL-941 to report

payment and return schedule.

You must pay and fi le electronically or

and pay all withholding income tax from

use Form IL-941-A

January 1 to the end of this quarter. You

There are exceptions. New taxpayers

then must use the semi-weekly payment

are automatically assigned to the month-

January 31 of the following year for amounts

and quarterly return schedule for the fol-

ly payment and quarterly return sched-

withheld the entire preceding year.

lowing quarter, the remainder of the year,

ule, as are those who would qualify for

and the subsequent year.

the annual return and payment sched-

ule, but are not in good standing with the

Who must use a Payment

• If you are assigned to the annual payment

department.

and return schedule, you may elect to

Coupon?

fi le quarterly returns and make monthly

You must use a Payment Coupon and send

payments. To do so, you must fi le Form

Withholding income tax is not

a payment using the monthly or semi-weekly

IL-941, for any quarter of the year. You

considered withheld until the date you

payment and quarterly return schedule we

must pay all amounts withheld from Janu-

pay your employees.

assigned to you. Taxpayers who are assigned

ary 1 through the end of that quarter. You

to the annual payment and return schedule

then must begin making monthly pay-

should fi le and pay each year, using Form

ments and fi ling quarterly returns for the

IL-941-A.

remainder of that year. See Publication

IL-501 Front (R-12/08)

We encourage you to pay electronically. Visit tax.illinois.gov

Illinois Department of Revenue

Payment Coupon

Check the appropriate box to tell us when you withheld the withholding income

IL-501

tax you are paying. Check one box only.

Complete the following information.

___ ___ ___ ___

Tax year

1

2

3

4

___ ___ - ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Jan

Apr

Jul

Oct

Federal employer identifi cation number

Seq. number

Feb

May

Aug

Nov

Mar

Jun

Sep

Dec

_______________________________________________

Business name

$

Amount paid:

___________________.____

_______________________________________________

• Send this Payment Coupon, Form IL-501, along with your remittance, payable

Number and street address

to “Illinois Department of Revenue”.

_______________________________________________

• Mail to:

ILLINOIS DEPARTMENT OF REVENUE

City

State

ZIP

PO BOX 19447

SPRINGFIELD IL 62794-9447

(_______)_______________________________________

• Do not mail us a Payment Coupon, Form IL-501, if you electronically pay or to

Daytime phone

report a zero amount.

IL-501 (R-12/08) IL-492-0053

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2