Form Il-501 Draft - Payment Coupon And Instructions - 2012

ADVERTISEMENT

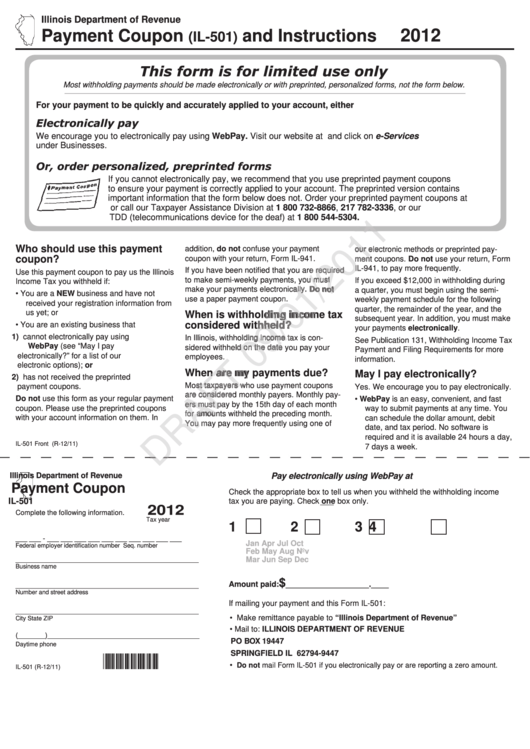

Illinois Department of Revenue

2012

Payment Coupon

and Instructions

(IL-501)

This form is for limited use only

Most withholding payments should be made electronically or with preprinted, personalized forms, not the form below.

For your payment to be quickly and accurately applied to your account, either

Electronically pay

We encourage you to electronically pay using WebPay. Visit our website at tax.illinois.gov and click on e-Services

under Businesses.

Or, order personalized, preprinted forms

If you cannot electronically pay, we recommend that you use preprinted payment coupons

to ensure your payment is correctly applied to your account. The preprinted version contains

important information that the form below does not. Order your preprinted payment coupons at

tax.illinois.gov or call our Taxpayer Assistance Division at 1 800 732-8866, 217 782-3336, or our

TDD (telecommunications device for the deaf) at 1 800 544-5304.

Who should use this payment

addition, do not confuse your payment

our electronic methods or preprinted pay-

our electronic methods or preprinted pay

our electronic methods or preprinted pay

coupon?

coupon with your return, Form IL-941.

ment coupons. Do not use your return, Form

ment coupons.

ment coupons.

IL-941, to pay more frequently.

IL-941, to pay more frequently.

IL-941, to pay more frequently.

If you have been notified that you are required

If you have been notified that you are required

If you have been notified that you are required

Use this payment coupon to pay us the Illinois

to make semi-weekly payments, you must

to make semi-weekly payments, you must

to make semi-weekly payments, you must

If you exceed $12,000 in withholding during

Income Tax you withheld if:

make your payments electronically. Do not

make your payments electronically.

make your payments electronically.

Do

Do

not

not

a quarter, you must begin using the semi-

• You are a NEW business and have not

use a paper payment coupon.

use a paper payment coupon.

use a paper payment coupon.

weekly payment schedule for the following

received your registration information from

quarter, the remainder of the year, and the

us yet; or

When is withholding income tax

withholding

withholding

income

income

subsequent year. In addition, you must make

considered withheld?

withheld?

withheld?

• You are an existing business that

your payments electronically.

1) cannot electronically pay using

In Illinois, withholding income tax is con-

In Illinois, withholding income tax is con

In Illinois, withholding income tax is con

See Publication 131, Withholding Income Tax

WebPay (see “May I pay

sidered withheld on the date you pay your

sidered withheld on the date you pay your

sidered withheld on the date you pay your

Payment and Filing Requirements for more

electronically?” for a list of our

employees.

information.

electronic options); or

When are my payments due?

When

When

are

are

my

my

payments

payments

May I pay electronically?

2) has not received the preprinted

Most taxpayers who use payment coupons

Most taxpayers who use payment coupons

Most taxpayers who use payment coupons

payment coupons.

Yes. We encourage you to pay electronically.

are considered monthly payers. Monthly pay-

are considered monthly payers. Monthly pay

are considered monthly payers. Monthly pay

Do not use this form as your regular payment

• WebPay is an easy, convenient, and fast

ers must pay by the 15th day of each month

ers must pay by the 15th day of each month

ers must pay by the 15th day of each month

coupon. Please use the preprinted coupons

way to submit payments at any time. You

for amounts withheld the preceding month.

for

for

amounts withheld the preceding month.

amounts withheld the preceding month.

with your account information on them. In

can schedule the dollar amount, debit

You may pay more frequently using one of

You may pay more frequently using one of

You may pay more frequently using one of

date, and tax period. No software is

required and it is available 24 hours a day,

IL-501 Front (R-12/11)

7 days a week.

Illinois Department of Revenue

Pay electronically using WebPay at tax.illinois.gov

Payment Coupon

Check the appropriate box to tell us when you withheld the withholding income

IL-501

tax you are paying. Check one box only.

2012

Complete the following information.

Tax year

1

2

3

4

___ ___ - ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Jan

Apr

Jul

Oct

Federal employer identification number

Seq. number

Feb

May

Aug

Nov

_______________________________________________

Mar

Jun

Sep

Dec

Business name

$

Amount paid:

___________________.____

_______________________________________________

Number and street address

If mailing your payment and this Form IL-501:

_______________________________________________

• Make remittance payable to “Illinois Department of Revenue”

City

State

ZIP

• Mail to:

ILLINOIS DEPARTMENT OF REVENUE

(_______)_______________________________________

PO BOX 19447

Daytime phone

SPRINGFIELD IL 62794-9447

*IL501*

•

Do not mail Form IL-501 if you electronically pay or are reporting a zero amount.

IL-501 (R-12/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3