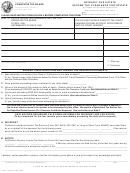

Form Ftb 4925 C2 - Application For Voluntary Disclosure Page 2

ADVERTISEMENT

Specific Entity Directions

Corporation defined in Section 23038

Complete Parts 6 through 8 . If more than one corporation in a single unitary combined reporting group wishes to

apply for voluntary disclosure relief, each corporation seeking relief must file a separate application, simultaneously

if possible .

S corporation defined in Section 23800

Complete Part 3 for qualified shareholders, in addition to Parts 6 through 8 .

LLC not classified as a corporation

Complete Part 4 for qualified members, in addition to Parts 6 through 8 .

Trust

Complete Part 5 for qualified beneficiaries, in addition to Parts 6 through 8 .

Part 3 – Information Required for Secondary Applicants - Qualified Shareholders

1. How many shareholders held an interest in the S corporation during the years to be covered

by the voluntary disclosure application? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ______________

a. How many of those shareholders are individuals? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ______________

Only shareholders who are individuals may enter the VDP .

b. Are all individual shareholders applying in connection with this application currently

California nonresidents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Individual shareholders must be also nonresidents on the signing date of the voluntary disclosure

application to be qualified shareholders .

2. Based on the above information, how many qualified shareholders are applying for the VDP in

connection with the qualified S corporation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ______________

3. State the reason, if any, that any shareholders of the primary S corporation applicant are not

applying for the VDP: _____________________________________________________________________________

4. Will the S corporation be filing a group nonresident return (See FTB Pub . 1067)? . . . . . . . . . . . . . . .

Yes

No

5. State the basis the qualified shareholders had for believing that they were immune from California tax: _____________

______________________________________________________________________________________________

6. Did the qualified shareholders rely upon the advice of a person in a fiduciary position or other

competent advice that they were immune from California tax? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If so, describe the nature of the advice you received, status and competency of the person giving

the advice, and the approximate date you received the advice: _____________________________________________

______________________________________________________________________________________________

7. Provide other information attesting to the qualified shareholders’ good faith and lack of willful neglect

in failing to file California tax returns and pay California taxes: _____________________________________________

______________________________________________________________________________________________

Qualified S corporation applicants must also complete Parts 6 through 8 below .

Part 4 – Information Required for Secondary Applicants - Qualified Members

1. How many members held an interest in the LLC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ______________

a. Of that amount, how many are individuals, corporations, and other LLCs? . . . . . . . . . . . . . . . . . . ______________

b. Are all individual members that are applying for relief in connection with this application

currently California nonresidents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Individual members must also be nonresidents on the signing date of the voluntary disclosure

application to be qualified members .

c. Are all corporations or LLCs that are applying for relief in connection with this

application not: organized under the laws of California; qualified or registered with the

California Secretary of State? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Corporate or LLC members may not enter the VDP if they are organized under the laws of

California, or qualified or registered with the California Secretary of State .

FTB 4925 c2 (REV 12-2015) PAGE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5