Form Ftb 4925 C2 - Application For Voluntary Disclosure Page 4

ADVERTISEMENT

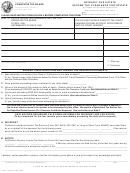

Part 6 – Exhibit A

Include the following information on a separate sheet labeled Exhibit A, and attach it to your voluntary disclosure

application . Provide the following information:

1. State of incorporation/organization for the primary applicant .

2. Primary applicant’s line(s) of business and describe its business activities inside and outside California .

3. Tax year the primary applicant began doing business anywhere .

4. Business activity that created California nexus for the primary applicant and tax year it was created .

5. If applicant is a member of a unitary group in which other members are applying for voluntary disclosure, applicants’

relationship to each other (parent, subsidiary, brother-sister affiliate) .

6. Beginning and ending dates of the primary applicant’s accounting period .

Part 7 – Exhibit B

On a separate sheet labeled Exhibit B, provide the information requested in the manner described below (or in a

comparable manner) for each period to be covered by the voluntary disclosure agreement:

A primary applicant entity, except for a qualified LLC applicant, should include the following information:

•

Federal taxable income before net operating losses (NOL) .

•

California net income and estimate of California tax due .

•

Estimated California net income and estimate of California tax due for any qualified shareholders and qualified

beneficiaries applying in connection with the primary applicant entity .

A qualified LLC applicant should state the:

•

Amount of the LLC’s total income from all sources derived from or attributable to California (See R&TC Section 17942).

•

California net income and the amount, if any, that will be withheld by the LLC for LLC members that do not consent

to California tax jurisdiction (see R&TC Section 18633.5). A member’s failure to provide its affirmative consent to

jurisdiction under Section 18633 .5 does not exempt that member from its California tax obligations .

•

LLC tax due.

•

LLC fee due (if any) and an estimate of California tax due from and for all qualified members that are applying for the

VDP in connection with the qualified LLC applicant .

Provide the income and tax information requested above for each applicant entity (primary and secondary) that is not an

LLC in the following format, and indicate if the entity is a primary or secondary applicant:

Tax Year, Starting From Most Recent

Federal Taxable

Income Before NOLs

CA Net Income

Estimate of CA Tax Due

(MM/DD/YYYY – MM/DD/YYYY)

1

2

3

4

5

6

FTB 4925 c2 (REV 12-2015) PAGE 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5