Form M-65-1 - Manufacturing Machinery And Equipment Exemption Claim - 2008

ADVERTISEMENT

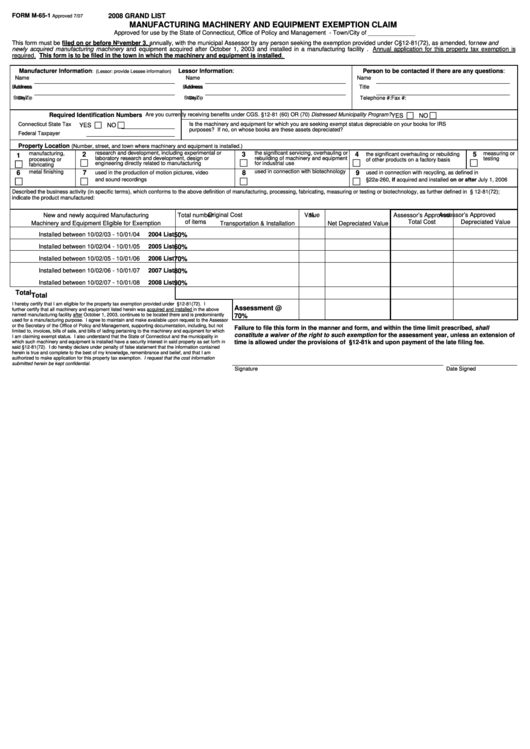

FORM M-65-1

2008 GRAND LIST

Approved 7/07

MANUFACTURING MACHINERY AND EQUIPMENT EXEMPTION CLAIM

Approved for use by the State of Connecticut, Office of Policy and Management - Town/City of ______________

This form must be filed on or before November 3, annually, with the municipal Assessor by any person seeking the exemption provided under C.G.S. §12-81(72), as amended, for new and

newly acquired manufacturing machinery and equipment acquired after October 1, 2003 and installed in a manufacturing facility . Annual application for this property tax exemption is

required. This form is to be filed in the town in which the machinery and equipment is installed.

Manufacturer Information

Lessor Information:

Person to be contacted if there are any questions:

: (Lessor: provide Lessee information)

Name

Name

Name

Business

Business

Title

Address

Address

City/

City/

Telephone #:

Fax #:

State/Zip

State/Zip

Required Identification Numbers

Are you currently receiving benefits under CGS. §12-81 (60) OR (70) Distressed Municipality Program?

YES

NO

Connecticut State Tax I.D. No.

Is the machinery and equipment for which you are seeking exempt status depreciable on your books for IRS

YES

NO

purposes? If no, on whose books are these assets depreciated?

Federal Taxpayer I.D. No.

Property Location

(Number, street, and town where machinery and equipment is installed.)

research and development, including experimental or

the significant servicing, overhauling or

manufacturing,

measuring or

2

3

4

the significant overhauling or rebuilding

5

1

laboratory research and development, design or

rebuilding of machinery and equipment

processing or

of other products on a factory basis

testing

engineering directly related to manufacturing

for industrial use

fabricating

used in connection with biotechnology

metal finishing

6

7

used in the production of motion pictures, video

8

9

used in connection with recycling, as defined in C.G.S.

and sound recordings

§22a-260, if acquired and installed on or after July 1, 2006

Described the business activity (in specific terms), which conforms to the above definition of manufacturing, processing, fabricating, measuring or testing or biotechnology, as further defined in C.G.S. § 12-81(72);

indicate the product manufactured:

New and newly acquired Manufacturing

Total number

Original Cost

%

Assessor’s Approved

Assessor’s Approved

of items

Value

Total Cost

Depreciated Value

Machinery and Equipment Eligible for Exemption

Transportation & Installation

Net Depreciated Value

Installed between 10/02/03 - 10/01/04

2004 List

50%

Installed between 10/02/04 - 10/01/05

2005 List

60%

Installed between 10/02/05 - 10/01/06

2006 List

70%

Installed between 10/02/06 - 10/01/07

2007 List

80%

Installed between 10/02/07 - 10/01/08

2008 List

90%

Total

Total

I hereby certify that I am eligible for the property tax exemption provided under C.G.S. §12-81(72). I

Assessment @

further certify that all machinery and equipment listed herein was acquired and installed in the above

named manufacturing facility after October 1, 2003, continues to be located there and is predominantly

70%

used for a manufacturing purpose. I agree to maintain and make available upon request to the Assessor

or the Secretary of the Office of Policy and Management, supporting documentation, including, but not

Failure to file this form in the manner and form, and within the time limit prescribed, shall

limited to, invoices, bills of sale, and bills of lading pertaining to the machinery and equipment for which

constitute a waiver of the right to such exemption for the assessment year, unless an extension of

I am claiming exempt status. I also understand that the State of Connecticut and the municipality in

time is allowed under the provisions of C.G.S. §12-81k and upon payment of the late filing fee.

which such machinery and equipment is installed have a security interest in said property as set forth in

said §12-81(72). I do hereby declare under penalty of false statement that the information contained

herein is true and complete to the best of my knowledge, remembrance and belief, and that I am

authorized to make application for this property tax exemption. I request that the cost information

submitted herein be kept confidential.

Signature

Date Signed

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3