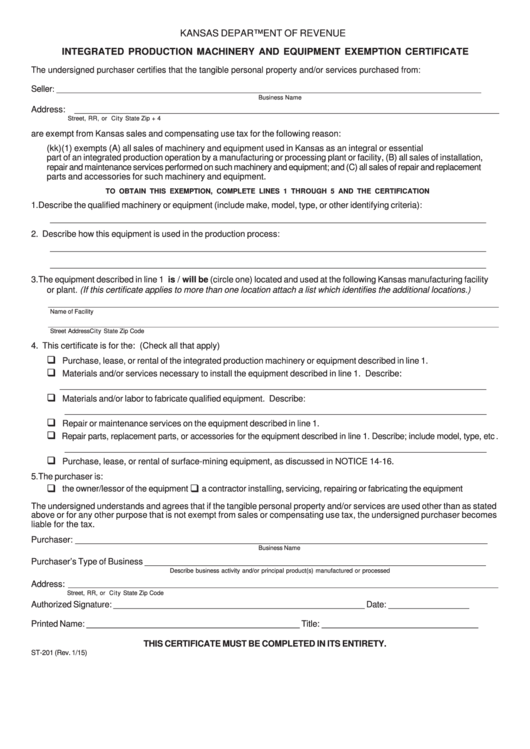

KANSAS DEPARTMENT OF REVENUE

INTEGRATED PRODUCTION MACHINERY AND EQUIPMENT EXEMPTION CERTIFICATE

The undersigned purchaser certifies that the tangible personal property and/or services purchased from:

Seller

:

_________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

Zip + 4

are exempt from Kansas sales and compensating use tax for the following reason:

K.S.A. 79-3606(kk)(1) exempts (A) all sales of machinery and equipment used in Kansas as an integral or essential

part of an integrated production operation by a manufacturing or processing plant or facility, (B) all sales of installation,

repair and maintenance services performed on such machinery and equipment; and (C) all sales of repair and replacement

parts and accessories for such machinery and equipment.

TO OBTAIN THIS EXEMPTION, COMPLETE LINES 1 THROUGH 5 AND THE CERTIFICATION

1. Describe the qualified machinery or equipment (include make, model, type, or other identifying criteria):

____________________________________________________________________________________________

2. Describe how this equipment is used in the production process:

____________________________________________________________________________________________

____________________________________________________________________________________________

3. The equipment described in line 1 is / will be (circle one) located and used at the following Kansas manufacturing facility

or plant. (If this certificate applies to more than one location attach a list which identifies the additional locations.)

____________________________________________________________________________________________________________________________________

Name of Facility

____________________________________________________________________________________________________________________________________

Street Address

City

State

Zip Code

4. This certificate is for the: (Check all that apply)

‰

Purchase, lease, or rental of the integrated production machinery or equipment described in line 1.

‰

Materials and/or services necessary to install the equipment described in line 1. Describe:

__________________________________________________________________________________________

‰

Materials and/or labor to fabricate qualified equipment. Describe:

_________________________________________________________________________________________

‰

Repair or maintenance services on the equipment described in line 1.

‰

Repair parts, replacement parts, or accessories for the equipment described in line 1. Describe; include model, type, etc.

_________________________________________________________________________________________

‰

Purchase, lease, or rental of surface-mining equipment, as discussed in NOTICE 14-16.

5. The purchaser is:

‰

‰

the owner/lessor of the equipment

a contractor installing, servicing, repairing or fabricating the equipment

The undersigned understands and agrees that if the tangible personal property and/or services are used other than as stated

above or for any other purpose that is not exempt from sales or compensating use tax, the undersigned purchaser becomes

liable for the tax.

Purchaser: _______________________________________________________________________________________

Business Name

Purchaser’s Type of Business ________________________________________________________________________

Describe business activity and/or principal product(s) manufactured or processed

Address:

______________________________________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

Zip Code

Authorized Signature: _____________________________________________________

Date: _________________

Printed Name: _____________________________________________ Title: _________________________________

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

ST-201 (Rev. 1/15)

1

1