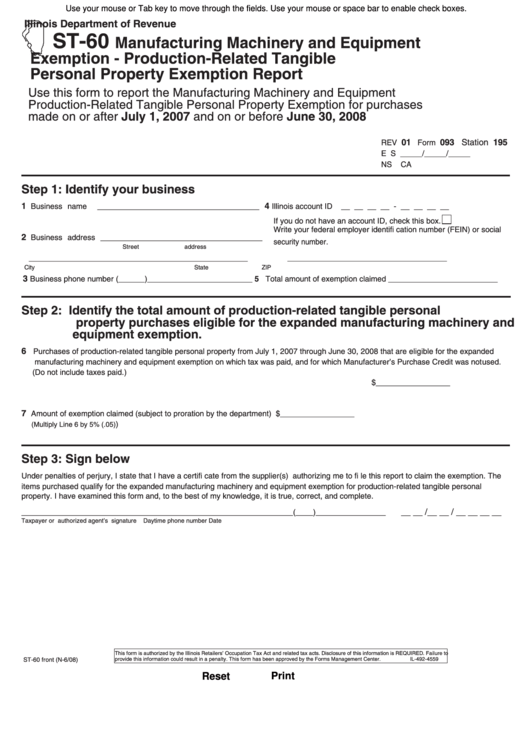

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

ST-60

Manufacturing Machinery and Equipment

Exemption - Production-Related Tangible

Personal Property Exemption Report

Use this form to report the Manufacturing Machinery and Equipment

Production-Related Tangible Personal Property Exemption for purchases

made on or after July 1, 2007 and on or before June 30, 2008

01

093 Station 195

REV

Form

E S _____/_____/_____

NS

CA

Step 1:

Identify your business

1

4

Business name

_____________________________________

Illinois account ID

__ __ __ __ - __ __ __ __

If you do not have an account ID, check this box.

Write your federal employer identifi cation number (FEIN) or social

2

Business address _____________________________________

security number.

Street address

__________________________________________________

_________________________________________

City

State

ZIP

3

Business phone number (______)________________________

5 Total amount of exemption claimed _________________________

Step 2: Identify the total amount of production-related tangible personal

property purchases eligible for the expanded manufacturing machinery and

equipment exemption.

6

Purchases of production-related tangible personal property from July 1, 2007 through June 30, 2008 that are eligible for the expanded

manufacturing machinery and equipment exemption on which tax was paid, and for which Manufacturer’s Purchase Credit was not used.

(Do not include taxes paid.)

$_________________

7

Amount of exemption claimed (subject to proration by the department)

$_________________

)

(Multiply Line 6 by 5% (.05)

Step 3: Sign below

Under penalties of perjury, I state that I have a certifi cate from the supplier(s) authorizing me to fi le this report to claim the exemption. The

items purchased qualify for the expanded manufacturing machinery and equipment exemption for production-related tangible personal

property. I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

__ __ /__ __ / __ __ __ __

______________________________________________________________(____)________________

Taxpayer or authorized agent’s signature

Daytime phone number

Date

This form is authorized by the Illinois Retailers’ Occupation Tax Act and related tax acts. Disclosure of this information is REQUIRED. Failure to

ST-60 front (N-6/08)

provide this information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-4559

Reset

Print

1

1