Application For Hearing Before The 2016 Guilford County Board Of Equalization And Review Page 2

ADVERTISEMENT

INSTRUCTIONS

By State Law, Guilford County assessed real estate values reflect the market value as of January 1, 2012, which is the

date of the last county-wide revaluation. Any inflation, deflation or other economic changes occurring after this date

do not affect the assessed value of the property and cannot be lawfully considered when reviewing the value for

adjustment.

The following instructions are to assist you in filing an appeal to the 2016 Guilford County Board of Equalization

and Review. These statements let you know what is required of an appellant, help you complete the form, and

help you identify the supportive material required.

GENERAL

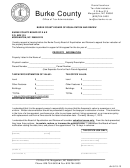

a. This form must be used in filing an appeal. A separate form is required for each parcel being appealed.

b. Return this form to : Guilford County Board of Equalization and Review

P. O. Box 3138

Greensboro, NC 27402

c. Incomplete, unsigned, or untimely forms have no standing and cannot be scheduled for a Board hearing.

d. Real Estate Appeals must be filed by 5:00 pm EST on June 1, 2016 to be heard for 2016 taxes.

e. Representatives of owners must provide signed Power of Attorney forms.

f. Hearings before the Board are by appointment only.

g. Appellants will be notified by first class mail of their appointed hearing date and time with the Board.

Failure to appear at the appointed time may result in dismissal of the appeal or the appeal will be heard in

the appellant’s absence.

h. The value placed on the property by the Tax Assessor’s Office is presumed to be correct under state law.

The appellant bears the burden of proving that the value substantially exceeds the fair market value of

the property and that the Tax Assessor used either an illegal or an arbitrary method of assessing the

property. Pertinent supportive information must accompany the appeal.

i. “Fair Market Value” is defined as the price at which the property would change hands between a willing

and financially able buyer and a willing seller, neither being under any compulsion to buy or to sell and

both having reasonable knowledge of all the uses to which the property is adapted and for which it is

capable of being used.

j. The Board cannot give an appeal proper consideration unless the appellant submits factual information in

support of the appellant’s contentions of being incorrectly assessed.

For Real Property Appeals the information should be in the form of maps, appraisals with effective

dates between 2010 and 2011, photographs, construction costs, or sales of comparable properties

that occurred between 2010 and 2011. In order to determine the market value as of January 1,

2012, any comparable sales information or appraisals provided by the appellant should have taken

place during 2010 or 2011. If they wish, Appellants may request to be contacted by the county

appraiser who will be reviewing their property.

If your appeal involves income producing (rental) property, income and expense statements for

2009, 2010, and 2011 must be provided for the Board’s consideration and review. All evidence

should be submitted to the Board with the original application for appeal. The material can be

delivered to the Clerk to the Board of Equalization and Review by mail, email or fax. Appeals

returned by email or fax should contain no more than three attachments.

Be aware the Board may agree with the Tax Assessor’s value, reduce the value, or raise the value

of any property appealed.

Additional information on the Board of Equalization and Review and appraisal records is available at:

Email:

Guilford County Tax Department/PO Box 3138/Greensboro, NC 27402

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2