Instructions For Form Nd-1ef - 2001

ADVERTISEMENT

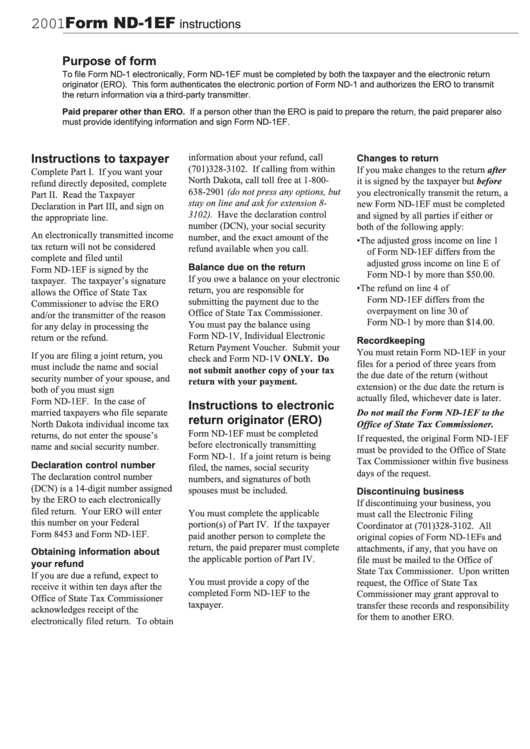

2001 Form ND-1EF

instructions

Purpose of form

To file Form ND-1 electronically, Form ND-1EF must be completed by both the taxpayer and the electronic return

originator (ERO). This form authenticates the electronic portion of Form ND-1 and authorizes the ERO to transmit

the return information via a third-party transmitter.

Paid preparer other than ERO. If a person other than the ERO is paid to prepare the return, the paid preparer also

must provide identifying information and sign Form ND-1EF.

Instructions to taxpayer

information about your refund, call

Changes to return

(701)328-3102. If calling from within

If you make changes to the return after

Complete Part I. If you want your

North Dakota, call toll free at 1-800-

it is signed by the taxpayer but before

refund directly deposited, complete

638-2901 (do not press any options, but

you electronically transmit the return, a

Part II. Read the Taxpayer

stay on line and ask for extension 8-

new Form ND-1EF must be completed

Declaration in Part III, and sign on

3102). Have the declaration control

and signed by all parties if either or

the appropriate line.

number (DCN), your social security

both of the following apply:

An electronically transmitted income

number, and the exact amount of the

• The adjusted gross income on line 1

tax return will not be considered

refund available when you call.

of Form ND-1EF differs from the

complete and filed until

adjusted gross income on line E of

Balance due on the return

Form ND-1EF is signed by the

Form ND-1 by more than $50.00.

If you owe a balance on your electronic

taxpayer. The taxpayer’s signature

• The refund on line 4 of

return, you are responsible for

allows the Office of State Tax

Form ND-1EF differs from the

submitting the payment due to the

Commissioner to advise the ERO

overpayment on line 30 of

Office of State Tax Commissioner.

and/or the transmitter of the reason

Form ND-1 by more than $14.00.

You must pay the balance using

for any delay in processing the

Form ND-1V, Individual Electronic

return or the refund.

Recordkeeping

Return Payment Voucher. Submit your

You must retain Form ND-1EF in your

If you are filing a joint return, you

check and Form ND-1V ONLY. Do

files for a period of three years from

must include the name and social

not submit another copy of your tax

the due date of the return (without

security number of your spouse, and

return with your payment.

extension) or the due date the return is

both of you must sign

actually filed, whichever date is later.

Form ND-1EF. In the case of

Instructions to electronic

married taxpayers who file separate

Do not mail the Form ND-1EF to the

return originator (ERO)

North Dakota individual income tax

Office of State Tax Commissioner.

Form ND-1EF must be completed

returns, do not enter the spouse’s

If requested, the original Form ND-1EF

before electronically transmitting

name and social security number.

must be provided to the Office of State

Form ND-1. If a joint return is being

Tax Commissioner within five business

Declaration control number

filed, the names, social security

days of the request.

The declaration control number

numbers, and signatures of both

(DCN) is a 14-digit number assigned

spouses must be included.

Discontinuing business

by the ERO to each electronically

If discontinuing your business, you

filed return. Your ERO will enter

You must complete the applicable

must call the Electronic Filing

this number on your Federal

portion(s) of Part IV. If the taxpayer

Coordinator at (701)328-3102. All

Form 8453 and Form ND-1EF.

paid another person to complete the

original copies of Form ND-1EFs and

return, the paid preparer must complete

attachments, if any, that you have on

Obtaining information about

the applicable portion of Part IV.

file must be mailed to the Office of

your refund

State Tax Commissioner. Upon written

If you are due a refund, expect to

You must provide a copy of the

request, the Office of State Tax

receive it within ten days after the

completed Form ND-1EF to the

Commissioner may grant approval to

Office of State Tax Commissioner

taxpayer.

transfer these records and responsibility

acknowledges receipt of the

for them to another ERO.

electronically filed return. To obtain

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1