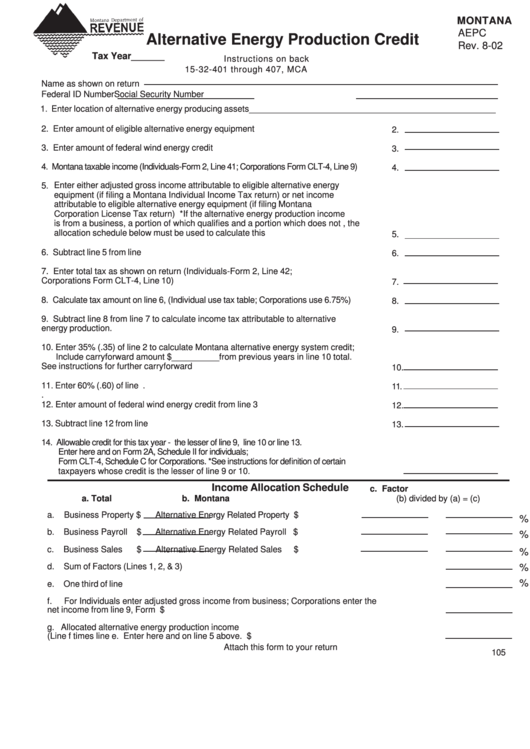

Form Aepc - Alternative Energy Production Credit

ADVERTISEMENT

MONTANA

AEPC

Alternative Energy Production Credit

Rev. 8-02

Tax Year

_______

Instructions on back

15-32-401 through 407, MCA

Name as shown on return

Federal ID Number

Social Security Number

1. Enter location of alternative energy producing assets____________________________________________________

2. Enter amount of eligible alternative energy equipment investment.....................................

2.

3. Enter amount of federal wind energy credit claimed..........................................................

3.

4. Montana taxable income (Individuals-Form 2, Line 41; Corporations Form CLT-4, Line 9).............

4.

Enter either adjusted gross income attributable to eligible alternative energy

5.

equipment (if filing a Montana Individual Income Tax return) or net income

attributable to eligible alternative energy equipment (if filing Montana

Corporation License Tax return) *If the alternative energy production income

is from a business, a portion of which qualifies and a portion which does not , the

allocation schedule below must be used to calculate this line...........................................

5.

6. Subtract line 5 from line 4..................................................................................................

6.

7. Enter total tax as shown on return (Individuals-Form 2, Line 42;

Corporations Form CLT-4, Line 10)...............................................................................

7.

8. Calculate tax amount on line 6, (Individual use tax table; Corporations use 6.75%)...............

8.

9. Subtract line 8 from line 7 to calculate income tax attributable to alternative

energy production. ............................................................................................................

9.

10. Enter 35% (.35) of line 2 to calculate Montana alternative energy system credit;

Include carryforward amount $__________from previous years in line 10 total.

See instructions for further carryforward information.......................................................

10.

11. Enter 60% (.60) of line 2...................................................................................................

11.

.

12. Enter amount of federal wind energy credit from line 3 above..........................................

12.

13. Subtract line 12 from line 11.............................................................................................

13.

14. Allowable credit for this tax year - the lesser of line 9, line 10 or line 13.

Enter here and on Form 2A, Schedule II for individuals;

Form CLT-4, Schedule C for Corporations. *See instructions for definition of certain

taxpayers whose credit is the lesser of line 9 or 10.........................................................

14.

Income Allocation Schedule

c. Factor

a. Total

b. Montana

(b) divided by (a) = (c)

a. Business Property $

Alternative Energy Related Property $

%

b.

Business Payroll

$

Alternative Energy Related Payroll $

%

c.

Business Sales

$

Alternative Energy Related Sales

$

%

d. Sum of Factors (Lines 1, 2, & 3)............................................................................................................

%

%

e. One third of line 4...................................................................................................................................

f.

For Individuals enter adjusted gross income from business; Corporations enter the

net income from line 9, Form CLT-4.....................................................................................................$

g. Allocated alternative energy production income

(Line f times line e. Enter here and on line 5 above. .......................................................................... $

Attach this form to your return

105

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1