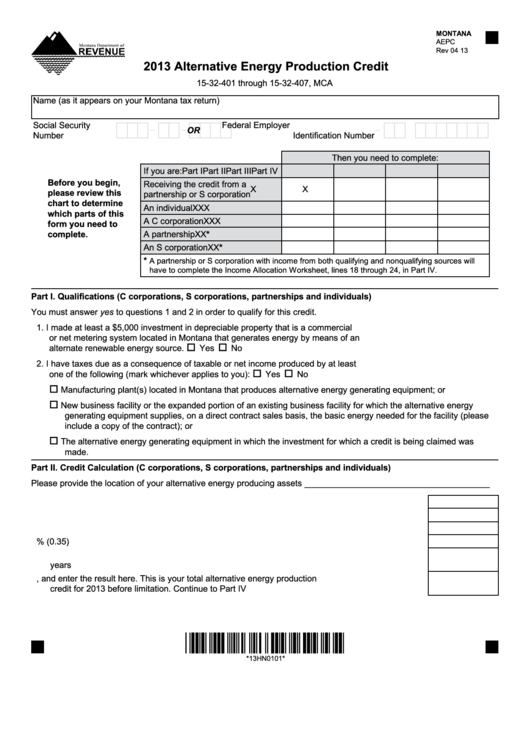

Montana Form Aepc - Alternative Energy Production Credit - 2013

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

MONTANA

4

4

AEPC

5

5

Rev 04 13

6

6

2013 Alternative Energy Production Credit

7

7

8

8

15-32-401 through 15-32-407, MCA

9

9

10

10

Name (as it appears on your Montana tax return)

11

11

100

12

12

Social Security

Federal Employer

110

120

-

-

-

X X X X X X X X X

X X X X X X X X X

13

OR

13

Number

Identification Number

14

14

15

15

Then you need to complete:

16

16

If you are:

Part I

Part II

Part III

Part IV

17

17

18

Before you begin,

18

Receiving the credit from a

X

X

19

19

please review this

partnership or S corporation

20

chart to determine

20

An individual

X

X

X

21

21

which parts of this

A C corporation

X

X

X

22

form you need to

22

23

complete.

A partnership

X

X

*

23

24

24

*

An S corporation

X

X

25

25

*

A partnership or S corporation with income from both qualifying and nonqualifying sources will

26

26

have to complete the Income Allocation Worksheet, lines 18 through 24, in Part IV.

27

27

28

28

Part I. Qualifications (C corporations, S corporations, partnerships and individuals)

29

29

30

30

You must answer yes to questions 1 and 2 in order to qualify for this credit.

31

31

32

1. I made at least a $5,000 investment in depreciable property that is a commercial

32

33

or net metering system located in Montana that generates energy by means of an

33

130

34

alternate renewable energy source.

Yes

No

34

35

35

2. I have taxes due as a consequence of taxable or net income produced by at least

36

36

140

one of the following (mark whichever applies to you):

Yes

No

37

37

150

38

Manufacturing plant(s) located in Montana that produces alternative energy generating equipment; or

38

39

39

160

New business facility or the expanded portion of an existing business facility for which the alternative energy

40

40

generating equipment supplies, on a direct contract sales basis, the basic energy needed for the facility (please

41

41

include a copy of the contract); or

42

42

170

43

The alternative energy generating equipment in which the investment for which a credit is being claimed was

43

44

made.

44

45

45

Part II. Credit Calculation (C corporations, S corporations, partnerships and individuals)

46

46

180

47

Please provide the location of your alternative energy producing assets _______________________________________

47

48

48

190

3. Enter the amount of your eligible alternative energy equipment investment .................................. 3.

49

49

200

50

50

4. Enter the amount of any grants you received ................................................................................. 4.

51

210

51

5. Subtract line 4 from line 3 ............................................................................................................... 5.

52

52

220

6. Multiply line 5 by 35% (0.35) .......................................................................................................... 6.

53

53

7. Enter any remaining alternative energy production credit carryforward amount from previous

54

54

230

years ............................................................................................................................................... 7.

55

55

56

56

8. Add lines 6 and 7, and enter the result here. This is your total alternative energy production

240

57

57

credit for 2013 before limitation. Continue to Part IV ...................................................................... 8.

58

58

59

59

60

60

61

61

*13HN0101*

62

62

63

63

64

64

*13HN0101*

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4