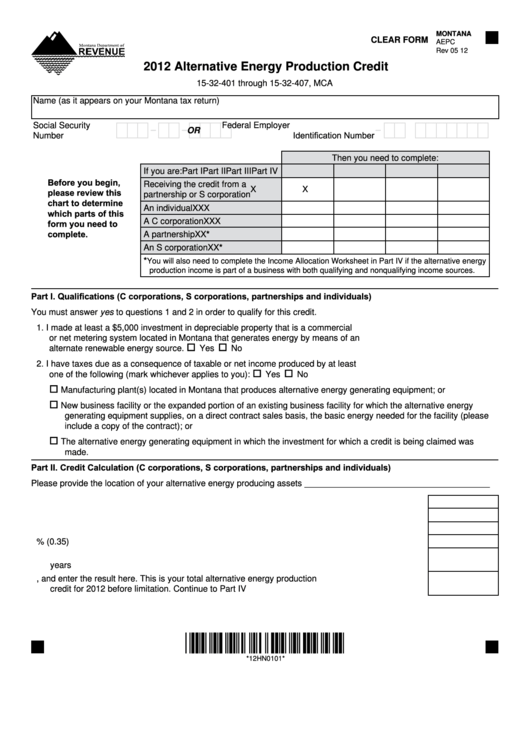

MONTANA

CLEAR FORM

AEPC

Rev 05 12

2012 Alternative Energy Production Credit

15-32-401 through 15-32-407, MCA

Name (as it appears on your Montana tax return)

Social Security

Federal Employer

-

-

-

OR

Identification Number

Number

Then you need to complete:

If you are:

Part I

Part II

Part III

Part IV

Before you begin,

Receiving the credit from a

X

X

please review this

partnership or S corporation

chart to determine

An individual

X

X

X

which parts of this

A C corporation

X

X

X

form you need to

complete.

A partnership

X

X

*

An S corporation

X

X

*

*

You will also need to complete the Income Allocation Worksheet in Part IV if the alternative energy

production income is part of a business with both qualifying and nonqualifying income sources.

Part I. Qualifications (C corporations, S corporations, partnerships and individuals)

You must answer yes to questions 1 and 2 in order to qualify for this credit.

1. I made at least a $5,000 investment in depreciable property that is a commercial

or net metering system located in Montana that generates energy by means of an

alternate renewable energy source.

Yes

No

2. I have taxes due as a consequence of taxable or net income produced by at least

one of the following (mark whichever applies to you):

Yes

No

Manufacturing plant(s) located in Montana that produces alternative energy generating equipment; or

New business facility or the expanded portion of an existing business facility for which the alternative energy

generating equipment supplies, on a direct contract sales basis, the basic energy needed for the facility (please

include a copy of the contract); or

The alternative energy generating equipment in which the investment for which a credit is being claimed was

made.

Part II. Credit Calculation (C corporations, S corporations, partnerships and individuals)

Please provide the location of your alternative energy producing assets _______________________________________

3. Enter the amount of your eligible alternative energy equipment investment .................................. 3.

4. Enter the amount of any grants you received ................................................................................. 4.

5. Subtract line 4 from line 3 ............................................................................................................... 5.

6. Multiply line 5 by 35% (0.35) .......................................................................................................... 6.

7. Enter any remaining alternative energy production credit carryforward amount from previous

years ............................................................................................................................................... 7.

8. Add lines 6 and 7, and enter the result here. This is your total alternative energy production

credit for 2012 before limitation. Continue to Part IV ...................................................................... 8.

*12HN0101*

*12HN0101*

1

1 2

2 3

3 4

4