Property Tax Appeal Form

Download a blank fillable Property Tax Appeal Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Property Tax Appeal Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

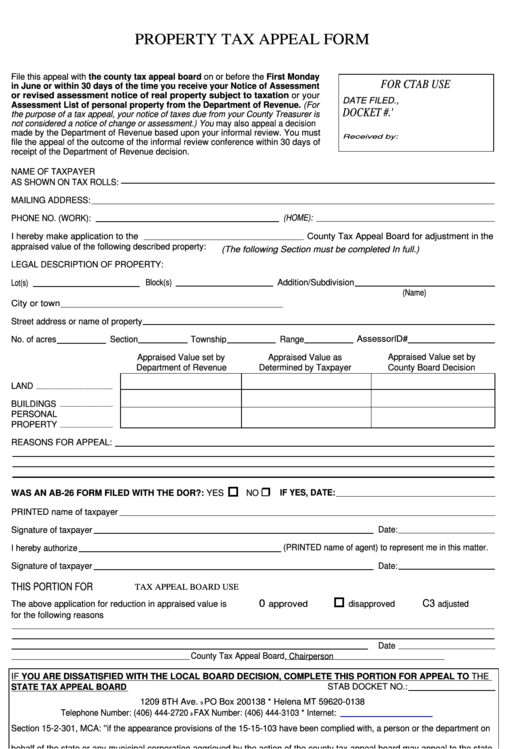

PROPERTY TAX APPEAL FORM

File this appeal with the county tax appeal board on or before the First Monday

FOR CTAB USE

in June or within 30 days of the time you receive your Notice of Assessment

or revised assessment notice of real property subject to taxation or your

DATE FILED.,

Assessment List of personal property from the Department of Revenue. (For

DOCKET #.'

the purpose of a tax appeal, your notice of taxes due from your County Treasurer is

not considered a notice of change or assessment.) You may also appeal a decision

made by the Department of Revenue based upon your informal review. You must

Received by:

file the appeal of the outcome of the informal review conference within 30 days of

receipt of the Department of Revenue decision.

NAME OF TAXPAYER

AS SHOWN ON TAX ROLLS:

MAILING ADDRESS:

(HOME):

PHONE NO. (WORK):

I hereby make application to the

County Tax Appeal Board for adjustment in the

appraised value of the following described property:

(The following Section must be completed In full.)

LEGAL DESCRIPTION OF PROPERTY:

Lot(s)

Block(s)

Addition/Subdivision

(Name)

City or town

Street address or name of property

AssessorlD#

No. of acres

Section

Township

Range

Appraised Value set by

Appraised Value set by

Appraised Value as

Department of Revenue

Determined by Taxpayer

County Board Decision

LAND

BUILDINGS

PERSONAL

PROPERTY

REASONS FOR APPEAL:

WAS AN AB-26 FORM FILED WITH THE DOR?: YES

NO

IF YES, DATE:

PRINTED name of taxpayer

Signature of taxpayer

Date:

(PRINTED name of agent) to represent me in this matter.

I hereby authorize

Signature of taxpayer

Date:

THIS PORTION FOR

TAX APPEAL BOARD USE

0

C3

The above application for reduction in appraised value is

approved

disapproved

adjusted

for the following reasons

Date

County Tax Appeal Board

, Chairperson

IF YOU ARE DISSATISFIED WITH THE LOCAL BOARD DECISION, COMPLETE THIS PORTION FOR APPEAL TO THE

STATE TAX APPEAL BOARD

STAB DOCKET NO.:

1209 8TH Ave.

PO Box 200138 * Helena MT 59620-0138

9

Telephone Number: (406) 444-2720

FAX Number: (406) 444-3103 * Internet:

9

Section 15-2-301, MCA: ''if the appearance provisions of the 15-15-103 have been complied with, a person or the department on

behalf of the state or any municipal corporation aggrieved by the action of the county tax appeal board may appeal to the state

board by filing with the state tax appeal board a notice of appeal within 30 calendar days after the receipt of the decision of the

county board. The notice must specify the action complained of and the reasons assigned for the complaint.''

I hereby appeal the action of the

County Tax Appeal Board, received

on

(date) for the following reasons:

Signature:

Date:

(Rev. M)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1