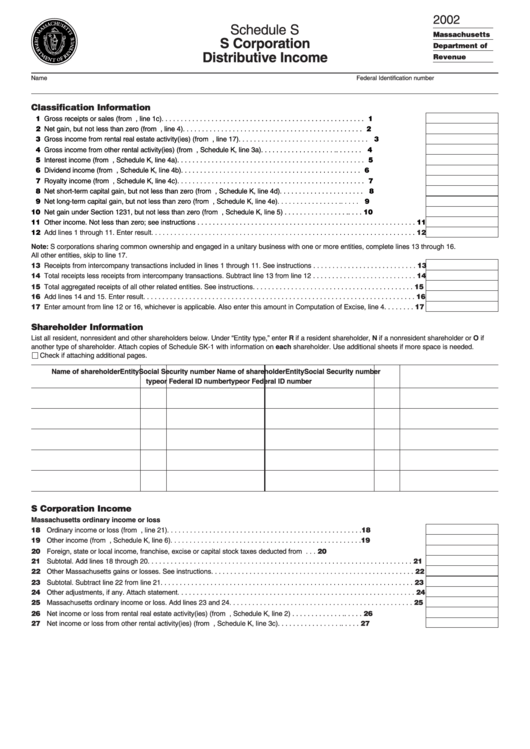

Schedule S - S Corporation Distributive Income, Schedule Sk-1 - Shareholder'S Massachusetts Information - 2002

ADVERTISEMENT

2002

Schedule S

Massachusetts

S Corporation

Department of

Distributive Income

Revenue

Name

Federal Identification number

Classification Information

11 Gross receipts or sales (from U.S. Form 1120S, line 1c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Net gain, but not less than zero (from U.S. Form 1120S, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Gross income from rental real estate activity(ies) (from U.S. Form 8825, line 17). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Gross income from other rental activity(ies) (from U.S. Form 1120S, Schedule K, line 3a) . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Interest income (from U.S. Form 1120S, Schedule K, line 4a). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Dividend income (from U.S. Form 1120S, Schedule K, line 4b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Royalty income (from U.S. Form 1120S, Schedule K, line 4c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Net short-term capital gain, but not less than zero (from U.S. Form 1120S, Schedule K, line 4d). . . . . . . . . . . . . . . . . . . . . . 18

19 Net long-term capital gain, but not less than zero (from U.S. Form 1120S, Schedule K, line 4e) . . . . . . . . . . . . . . . . . . . . . . 19

10 Net gain under Section 1231, but not less than zero (from U.S. Form 1120S, Schedule K, line 5) . . . . . . . . . . . . . . . . . . . . . 10

11 Other income. Not less than zero; see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

Add lines 1 through 11. Enter result. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Note: S corporations sharing common ownership and engaged in a unitary business with one or more entities, complete lines 13 through 16.

All other entities, skip to line 17.

13 Receipts from intercompany transactions included in lines 1 through 11. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Total receipts less receipts from intercompany transactions. Subtract line 13 from line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Total aggregated receipts of all other related entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Add lines 14 and 15. Enter result. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Enter amount from line 12 or 16, whichever is applicable. Also enter this amount in Computation of Excise, line 4 . . . . . . . . 17

Shareholder Information

List all resident, nonresident and other shareholders below. Under “Entity type,” enter R if a resident shareholder, N if a nonresident shareholder or O if

another type of shareholder. Attach copies of Schedule SK-1 with information on each shareholder. Use additional sheets if more space is needed.

Check if attaching additional pages.

Name of shareholder

Entity

Social Security number

Name of shareholder

Entity

Social Security number

type

or Federal ID number

type

or Federal ID number

S Corporation Income

Massachusetts ordinary income or loss

18 Ordinary income or loss (from U.S. Form 1120S, line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Other income (from U.S. Form 1120S, Schedule K, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Foreign, state or local income, franchise, excise or capital stock taxes deducted from U.S. net income . . . . . . . . . . . . . . . . 20

21 Subtotal. Add lines 18 through 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Other Massachusetts gains or losses. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Subtotal. Subtract line 22 from line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Other adjustments, if any. Attach statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Massachusetts ordinary income or loss. Add lines 23 and 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Net income or loss from rental real estate activity(ies) (from U.S. Form 1120S, Schedule K, line 2) . . . . . . . . . . . . . . . . . . . 26

27 Net income or loss from other rental activity(ies) (from U.S. Form 1120S, Schedule K, line 3c) . . . . . . . . . . . . . . . . . . . . . . 27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3