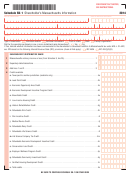

Schedule S - S Corporation Distributive Income, Schedule Sk-1 - Shareholder'S Massachusetts Information - 2002 Page 3

ADVERTISEMENT

2002

Schedule SK-1

Massachusetts

Shareholder’s Massachusetts

Department of

Information

Revenue

For calendar year 2002 or taxable year beginning

and ending

Name of shareholder

Social Security or Federal Identification number

Street address

City/Town

State

Zip

Name of S corporation

Federal Identification number

Street address

City/Town

State

Zip

Individual resident

Individual nonresident

Trust

Estate

Type of shareholder:

Shareholder’s Distributive Share

The S corporation has completed the information on this tax schedule. Refer to Shareholder’s Instructions for Schedule SK-1 on the back before entering

information from this tax schedule on your tax return. For a nonresident shareholder eligible to apportion, enter in column b the amount of the shareholder’s

share of each applicable distributive share item multiplied by the apportionment percentage in Form 355S, Schedule F, line 5. For line 8, enter the amount

of the shareholder’s share without apportionment. For all other shareholders, enter in column b the amount of the shareholder’s share of each applicable

distributive share item.

b. Shareholder’s Mass.

c. Form 1, 1-NR/PY or 2 filers, use the amount

a. Distributive share line

distributive amount

in col. b to complete the following schedules:

11 Massachusetts ordinary income or loss (from Schedule S, line 25)

12 Separately stated deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Combine lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 1 or 1-NR/PY, Schedule E, Part II, or Form 2

14 Credits:

Taxes paid to another state or jurisdiction (for

residents only)

Lead paint

EOA

FEC

Brownfields

Low Income Housing . . . . . . . . . . . . . . . . . . . . .

See SK-1 instructions

15 Net income or loss from rental real estate activity(ies)

(from Schedule S, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

See SK-1 instructions

16 Net income or loss from other rental activity(ies)

(from Schedule S, line 27) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

See SK-1 instructions

17 5.3% interest from Massachusetts banks (from Schedule S, line 30)

See SK-1 instructions

18 Interest on U.S. obligations (from Schedule S, line 29) . . . . . . . . . .

See SK-1 instructions

19 Non-Massachusetts state and municipal bond interest

(from Schedule S, line 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

See SK-1 instructions

10 Other interest and dividend income (from Schedule S, line 31) . . . .

See SK-1 instructions

11 Royalty income (from Schedule S, line 33) . . . . . . . . . . . . . . . . . . .

See SK-1 instructions

12 Other Income (from Schedule S, line 34) . . . . . . . . . . . . . . . . . . . . .

See SK-1 instructions

13 Short-term capital gains (from Schedule S, line 35) . . . . . . . . . . . . .

Forms 1, 1-NR/PY or 2, Sch. B

14 Short-term capital losses (from Schedule S, line 36) . . . . . . . . . . . .

Forms 1, 1-NR/PY or 2, Sch. B

15 Gain on the sale, exchange or involuntary conversion

of property used in a trade or business and held for

one year or less (from Schedule S, line 37) . . . . . . . . . . . . . . . . . . .

Forms 1, 1-NR/PY or 2, Sch. B

16 Loss on the sale, exchange or involuntary conversion

of property used in a trade or business and held for

one year or less (from Schedule S, line 38) . . . . . . . . . . . . . . . . . . .

Forms 1, 1-NR/PY or 2, Sch. B

17 Long-term capital gain or loss (from Schedule S, line 39)* . . . . . . .

Forms 1, 1-NR/PY or 2, Sch. D

18 Net gain or loss under Section 1231 (from Schedule S, line 40)*. . . .

Forms 1, 1-NR/PY or 2, Sch. B & D

19 Other long-term gains and losses (from Schedule S, line 41)*. . . . .

Forms 1, 1-NR/PY or 2, Sch. B & D

20 Long-term gains on collectibles (from Schedule S, line 42)* . . . . . .

Forms 1, 1-NR/PY or 2, Sch. B & D

21 Differences and adjustments, if any (from Schedule S, line 43) . . . .

*The S corporation may provide each shareholder with a breakdown of long-term capital gains and losses by the applicable holding period(s) and transaction dates. If the S cor-

poration does not do so, all long-term capital gains and losses, excluding long-term gains on collectibles, are to be taxed at 5.3%.

Shareholder’s Basis Information

a. Number of shares

b. Amount

22 Federal basis as of 12-31-85, or later year, if applicable

(See instructions and specify year here: ___________ )

23 Massachusetts basis

24 Net Massachusetts

26 Massachusetts basis at

at beginning of year

adjustments

25 Net federal adjustments

end of year (23 + 24)

Stock

Indebtedness

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3