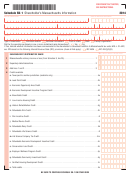

Schedule S - S Corporation Distributive Income, Schedule Sk-1 - Shareholder'S Massachusetts Information - 2002 Page 2

ADVERTISEMENT

U.S. portfolio income

28 U.S. portfolio income, not including capital gains (from U.S. Form 1120S, Schedule K, lines 4a, 4b, 4c and 4f) . . . . . . . . . . 28

29 Interest on U.S. obligations included in line 28. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

30 5.3% interest from savings deposits in Massachusetts banks included in line 28. Attach statement listing sources

and amounts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

31 Other interest and dividend income included in line 28. Attach statement listing sources and amounts . . . . . . . . . . . . . . . . 31

32 Non-Massachusetts state and municipal bond interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

33 Royalty income included in line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

34 Other income included in line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Massachusetts Capital Gains and Losses

35 Total short-term capital gains included in U.S. Form 1120S, Schedule D, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

36 Total short-term capital losses included in U.S. Form 1120S, Schedule D, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

37 Gain on the sale, exchange or involuntary conversion of property used in a trade or business and held for one year

or less (from U.S. Form 4797) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

38 Loss on the sale, exchange or involuntary conversion of property used in a trade or business and held for one year

or less (from U.S. Form 4797) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

39 Net long-term capital gain or loss (from U.S. Form 1120S, Schedule D, line 14). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

40 Net gain or loss under Section 1231 (from U.S. Form 1120S, Schedule K, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

41 Other long-term gains or losses. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

42 Long-term gains on collectibles included in line 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

43 Differences and adjustments. Attach statement. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Resident and Nonresident Reconciliation

Complete lines 44 through 47 only if there is one or more nonresident shareholders, income was derived from business activities in another state, and such

activities provide such state the jurisdiction to levy an income tax or a franchise tax. To accurately complete lines 44 through 47, first complete Schedule F,

Income Apportionment.

45.

Nonresident taxable income.

47.

44.

Multiply line 44 by

Apportioned

Total nonresidents’

apportionment percentage in

46.

Massachusetts total.

shares

Form 355S, Schedule F, line 5

Total residents’ shares

Add lines 45 and 46

a Line 25 . . . . . . . . . . . . . . .

b Line 26 . . . . . . . . . . . . . . .

c Line 27 . . . . . . . . . . . . . . .

d Line 30 . . . . . . . . . . . . . . .

e Line 31 . . . . . . . . . . . . . . .

f Line 32 . . . . . . . . . . . . . . .

g Line 33 . . . . . . . . . . . . . . .

h Line 34 . . . . . . . . . . . . . . .

i Line 35 . . . . . . . . . . . . . . .

j Line 36 . . . . . . . . . . . . . . .

k Line 37 . . . . . . . . . . . . . . .

l Line 38 . . . . . . . . . . . . . . .

m Line 39 . . . . . . . . . . . . . . .

n Line 40 . . . . . . . . . . . . . . .

o Line 41 . . . . . . . . . . . . . . .

p Line 42 . . . . . . . . . . . . . . .

q Line 43 . . . . . . . . . . . . . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3