Schedule B Corporation And Partnership - Recapture Of Investment Credit Claimed In Excess, Tax Credits, And Other Payments And Withholdings Page 2

ADVERTISEMENT

Rev. 05.02

Schedule B Corporation and Partnership - Page 2

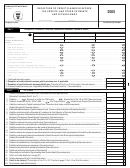

Part III

Other Payments and Withholdings

B3

1.

Tax paid with automatic extension of time .....................................................................................

(1)

0 0

2.

Estimated tax payments for 2002 ................................................................................................

(2)

0 0

3.

Tax paid in excess on previous years credited to estimated tax .....................................................

(3)

0 0

4.

Tax withheld at source ................................................................................................................

(4)

0 0

5.

Services rendered (Form 480.6B) .................................................................................................

(5)

0 0

6.

Tax withheld at source on distributable share to partners of special partnerships (Form 480.6 SE) ..........

(6)

0 0

7.

Total Other Payments and Withholdings (Add lines 1 through 6. Enter on Form 480.10 or

480.20, Part III, line 21) ...............................................................................................................

(7)

0 0

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2