Reset Form

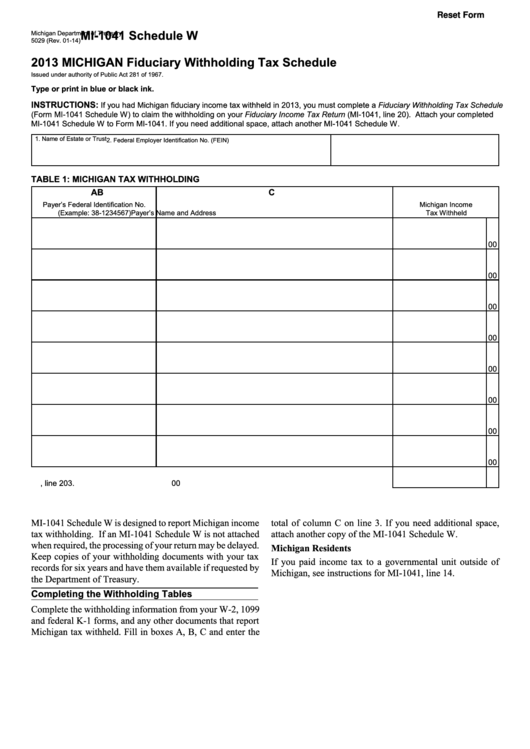

MI-1041 Schedule W

Michigan Department of Treasury

5029 (Rev. 01-14)

2013 MICHIGAN Fiduciary Withholding Tax Schedule

Issued under authority of Public Act 281 of 1967.

Type or print in blue or black ink.

INSTRUCTIONS:

If you had Michigan fiduciary income tax withheld in 2013, you must complete a Fiduciary Withholding Tax Schedule

(Form MI-1041 Schedule W) to claim the withholding on your Fiduciary Income Tax Return (MI-1041, line 20). Attach your completed

MI-1041 Schedule W to Form MI-1041. If you need additional space, attach another MI-1041 Schedule W.

1. Name of Estate or Trust

2. Federal Employer Identification No. (FEIN)

TABLE 1: MICHIGAN TAX WITHHOLDING

A

B

C

Payer’s Federal Identification No.

Michigan Income

(Example: 38-1234567)

Payer’s Name and Address

Tax Withheld

00

00

00

00

00

00

00

00

3. TOTAL. Add Column C. Enter here and carry to MI-1041, line 20 ............................................

3.

00

MI-1041 Schedule W is designed to report Michigan income

total of column C on line 3. If you need additional space,

tax withholding. If an MI-1041 Schedule W is not attached

attach another copy of the MI-1041 Schedule W.

when required, the processing of your return may be delayed.

Michigan Residents

Keep copies of your withholding documents with your tax

If you paid income tax to a governmental unit outside of

records for six years and have them available if requested by

Michigan, see instructions for MI-1041, line 14.

the Department of Treasury.

Completing the Withholding Tables

Complete the withholding information from your W-2, 1099

and federal K-1 forms, and any other documents that report

Michigan tax withheld. Fill in boxes A, B, C and enter the

1

1