Dc Estate Tax Return Form D-76 & Form D-76 Ez - General Instructions

ADVERTISEMENT

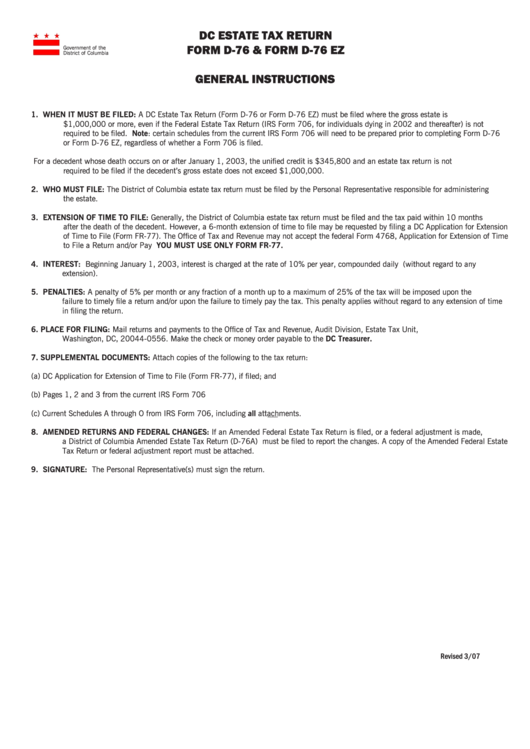

DC ESTATE TAX RETURN

FORM D-76 & FORM D-76 EZ

Government of the

District of Columbia

GENERAL INSTRUCTIONS

1.

WHEN IT MUST BE FILED: A DC Estate Tax Return (Form D-76 or Form D-76 EZ) must be filed where the gross estate is

$1,000,000 or more, even if the Federal Estate Tax Return (IRS Form 706, for individuals dying in 2002 and thereafter) is not

required to be filed. Note: certain schedules from the current IRS Form 706 will need to be prepared prior to completing Form D-76

or Form D-76 EZ, regardless of whether a Form 706 is filed.

For a decedent whose death occurs on or after January 1, 2003, the unified credit is $345,800 and an estate tax return is not

required to be filed if the decedent’s gross estate does not exceed $1,000,000.

2.

WHO MUST FILE: The District of Columbia estate tax return must be filed by the Personal Representative responsible for administering

the estate.

3.

EXTENSION OF TIME TO FILE: Generally, the District of Columbia estate tax return must be filed and the tax paid within 10 months

after the death of the decedent. However, a 6-month extension of time to file may be requested by filing a DC Application for Extension

of Time to File (Form FR-77). The Office of Tax and Revenue may not accept the federal Form 4768, Application for Extension of Time

to File a Return and/or Pay U.S. Estate Taxes. YOU MUST USE ONLY FORM FR-77.

4.

INTEREST: Beginning January 1, 2003, interest is charged at the rate of 10% per year, compounded daily (without regard to any

extension).

5.

PENALTIES: A penalty of 5% per month or any fraction of a month up to a maximum of 25% of the tax will be imposed upon the

failure to timely file a return and/or upon the failure to timely pay the tax. This penalty applies without regard to any extension of time

in filing the return.

6.

PLACE FOR FILING: Mail returns and payments to the Office of Tax and Revenue, Audit Division, Estate Tax Unit, P .O. Box 556

Washington, DC, 20044-0556. Make the check or money order payable to the DC Treasurer.

7.

SUPPLEMENTAL DOCUMENTS: Attach copies of the following to the tax return:

(a)

DC Application for Extension of Time to File (Form FR-77), if filed; and

(b)

Pages 1, 2 and 3 from the current IRS Form 706

(c)

Current Schedules A through O from IRS Form 706, including all attachments.

8.

AMENDED RETURNS AND FEDERAL CHANGES: If an Amended Federal Estate Tax Return is filed, or a federal adjustment is made,

a District of Columbia Amended Estate Tax Return (D-76A) must be filed to report the changes. A copy of the Amended Federal Estate

Tax Return or federal adjustment report must be attached.

9.

SIGNATURE: The Personal Representative(s) must sign the return.

Revised 3/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4