Property Tax Relief Application For 2005 - City Of Pittsburgh Page 2

ADVERTISEMENT

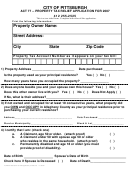

CITY OF PITTSBURGH

ACT 77 -- PROPERTY TAX RELIEF APPLICATION FOR 2005

SIDE TWO

Did you file a 2003 State Property Tax Rebate application? Yes ( )

No ( )

Did you file a 2003 Federal Tax Return? Yes ( )

No ( )

List below AND enclose proof of your household income for the year 2003:

You must complete this section and include proof of income or we cannot process your application.

You must attach copies of your State Property Tax Rebate Form or Federal Tax Return, W-2 forms

and Social Security Statements. Do not send your original documents. Income may be compared to IRS

records.

1) GROSS SALARY, WAGES, BONUSES, COMMISSIONS

$ _______________

2) 50% OF SOCIAL SECURITY, SSI & RAILROAD RETIREMENT

$ _______________

BENEFITS (reported on the blue and white Form RRB-1099)

3) PENSIONS, ANNUITIES AND IRA DISTRIBUTIONS

$ _______________

4) INTEREST, DIVIDENDS & CAPITAL GAINS

$ _______________

5) BUSINESS INCOME, SELF-EMPLOYMENT INCOME, RENTAL INCOME

$ _______________

6) ALIMONY OR SUPPORT, UNEMPLOYMENT, WORKERS COMPENSATION

$ _______________

7) OTHER INCOME (ATTACH A SCHEDULE & EXPLANATION)

$ _______________

TOTAL HOUSEHOLD INCOME (ADD LINES 1 THROUGH 7

$ _______________

)

I certify that this claim is true, correct and complete to the best of my knowledge and belief. An excessive

claim made with fraudulent intent can subject the claimant to a misdemeanor punishable by law.

Claimant’s Signature

Date

Preparer’s Signature

Date

_____________________________

Claimant’s Home Phone Number

Work Phone Number

This application should be filed by November 30, 2004 for your 2005 Real Estate Taxes.

Attach proof of 2003 income and return completed application to:

City Of Pittsburgh

Act 77 -- Senior Tax Relief

414 Grant Street

Pittsburgh, PA 15219

F:\Transfer folder\senior tax relief application year 2005.doc

rev 8/1/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2