Form Dtf-622 - Claim For Qetc Capital Tax Credit - 1999

ADVERTISEMENT

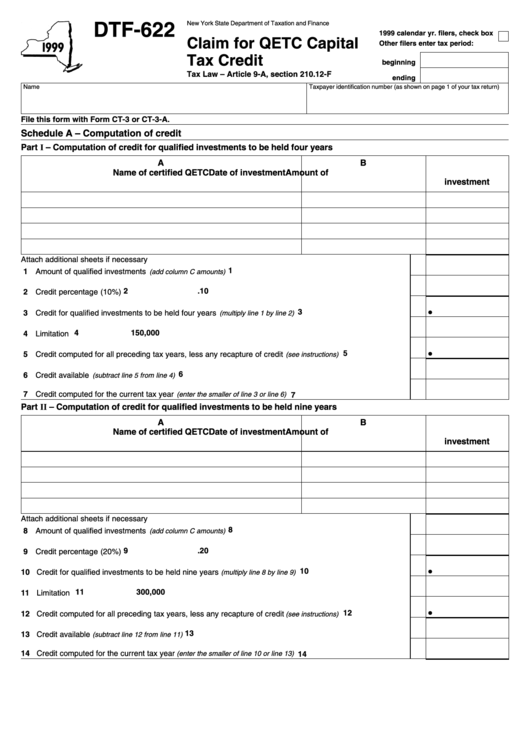

New York State Department of Taxation and Finance

DTF-622

1999 calendar yr. filers, check box

Claim for QETC Capital

Other filers enter tax period:

Tax Credit

beginning

Tax Law – Article 9-A, section 210.12-F

ending

Name

Taxpayer identification number (as shown on page 1 of your tax return)

File this form with Form CT-3 or CT-3-A.

Schedule A – Computation of credit

Part I – Computation of credit for qualified investments to be held four years

A

B

C

Name of certified QETC

Date of investment

Amount of

investment

Attach additional sheets if necessary

1

1 Amount of qualified investments

..................................................................................

(add column C amounts)

2

.10

2 Credit percentage (10%) ..................................................................................................................................

3

3 Credit for qualified investments to be held four years

..................................................

(multiply line 1 by line 2)

4

150,000

4 Limitation ..........................................................................................................................................................

5

5 Credit computed for all preceding tax years, less any recapture of credit

.............................

(see instructions)

6

6 Credit available

.........................................................................................................

(subtract line 5 from line 4)

7 Credit computed for the current tax year

.....................................................

(enter the smaller of line 3 or line 6)

7

Part II – Computation of credit for qualified investments to be held nine years

A

B

C

Name of certified QETC

Date of investment

Amount of

investment

Attach additional sheets if necessary

8

8 Amount of qualified investments

..................................................................................

(add column C amounts)

9

.20

9 Credit percentage (20%) ..................................................................................................................................

10

10 Credit for qualified investments to be held nine years

.................................................

(multiply line 8 by line 9)

11

300,000

11 Limitation ..........................................................................................................................................................

12

12 Credit computed for all preceding tax years, less any recapture of credit

.............................

(see instructions)

13

13 Credit available

......................................................................................................

(subtract line 12 from line 11)

14 Credit computed for the current tax year

..................................................

(enter the smaller of line 10 or line 13)

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2