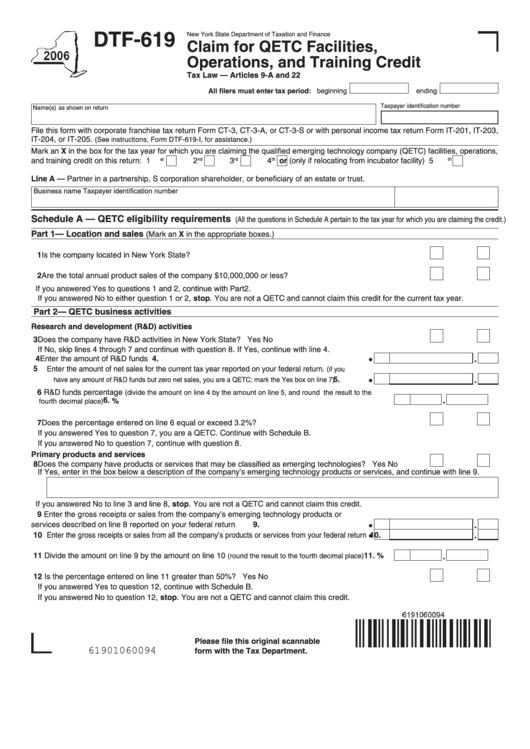

DTF-619

New York State Department of Taxation and Finance

Claim for QETC Facilities,

Operations, and Training Credit

Tax Law — Articles 9-A and 22

All filers must enter tax period:

beginning

ending

Taxpayer identification number

Name(s) as shown on return

File this form with corporate franchise tax return Form CT-3, CT-3-A, or CT-3-S or with personal income tax return Form IT-201, IT-203,

IT-204, or IT-205.

(See instructions, Form DTF-619-I, for assistance.)

Mark an X in the box for the tax year for which you are claiming the qualified emerging technology company (QETC) facilities, operations,

and training credit on this return:

1

2

3

4

or (only if relocating from incubator facility) 5

st

nd

rd

th

th

Line A — Partner in a partnership, S corporation shareholder, or beneficiary of an estate or trust.

Business name

Taxpayer identification number

Schedule A — QETC eligibility requirements

(All the questions in Schedule A pertain to the tax year for which you are claiming the credit.)

Part 1 — Location and sales

(Mark an X in the appropriate boxes.)

1 Is the company located in New York State? .................................................................................................... Yes

No

2 Are the total annual product sales of the company $10,000,000 or less? . ...................................................... Yes

No

If you answered Yes to questions 1 and 2, continue with Part 2.

If you answered No to either question 1 or 2, stop. You are not a QETC and cannot claim this credit for the current tax year.

Part 2 — QETC business activities

Research and development (R&D) activities

3 Does the company have R&D activities in New York State? .......................................................................... Yes

No

If No, skip lines 4 through 7 and continue with question 8. If Yes, continue with line 4.

4 Enter the amount of R&D funds .................................................................................................

4.

5 Enter the amount of net sales for the current tax year reported on your federal return.

(if you

...............

5.

have any amount of R&D funds but zero net sales, you are a QETC; mark the Yes box on line 7)

6 R&D funds percentage

(divide the amount on line 4 by the amount on line 5, and round the result to the

. ............................................................................................................................ 6.

%

fourth decimal place)

7 Does the percentage entered on line 6 equal or exceed 3.2%? ..................................................................... Yes

No

If you answered Yes to question 7, you are a QETC. Continue with Schedule B.

If you answered No to question 7, continue with question 8.

Primary products and services

8 Does the company have products or services that may be classified as emerging technologies? ................. Yes

No

If Yes, enter in the box below a description of the company’s emerging technology products or services, and continue with line 9.

If you answered No to line 3 and line 8, stop. You are not a QETC and cannot claim this credit.

9 Enter the gross receipts or sales from the company’s emerging technology products or

services described on line 8 reported on your federal return .................................................

9.

10 Enter the gross receipts or sales from all the company’s products or services from your federal return 10.

11 Divide the amount on line 9 by the amount on line 10

. .......... 11.

%

(round the result to the fourth decimal place)

12 Is the percentage entered on line 11 greater than 50%? ................................................................................ Yes

No

If you answered Yes to question 12, continue with Schedule B.

If you answered No to question 12, stop. You are not a QETC and cannot claim this credit.

Please file this original scannable

61901060094

form with the Tax Department.

1

1 2

2 3

3 4

4