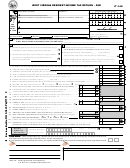

Form It-140 - West Virginia Resident Income Tax Return - Long Form - 1999 Page 2

ADVERTISEMENT

WEST VIRGINIA SCHEDULES M and E, and EARNED INCOME EXCLUSION WORKSHEET

If you are claiming a disability modification on line 35, be sure to attach Schedule H to your return.

Modifications INCREASING federal adjusted gross income (additions)

22

22.

Interest or dividend income on federal obligations which is exempt from federal tax but subject to state tax ..........

23

23.

Interest or dividend income on state and local bonds other than bonds from West Virginia sources ......................

24

Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax ...........................

24.

25

25.

Qualifying 402(e) lump-sum income NOT included in federal adjusted gross income but subject to state tax .......

26

Other income deducted from federal adjusted gross income but subject to state tax .............................................

26.

27

27.

Withdrawals from a medical savings account NOT used for payment of qualifying medical expenses ..................

28

28.

TOTAL ADDITIONS (add lines 22 through 27). Enter here and on line 2 of Form IT-140 ....................................

Modifications DECREASING federal adjusted gross income (subtractions)

Column A (You)

Column B (Spouse)

29.

Interest or dividends received on United States or West Virginia obligations

29

includible in federal adjusted gross income but exempt from state tax ................................

30.

Total amount of any benefit (including survivorship annuities) received from

30

any West Virginia state or local police, deputy sheriff’s or firemen's retirement system ......

Up to $2,000 of benefits received from West Virginia Teachers Retirement System,

31.

West Virginia Public Employees Retirement System, federal retirement systems

31

(Title 4 USC § 111), and any form of military retirement .....................................................

32.

Income received and includible in federal adjusted gross income but exempt from state

tax by federal law. Include contributions made to a West Virginia Medical Savings Account.

32

State the source and amount of exempt income

33

33.

Refunds of state and local income taxes received and reported as income to the IRS ........

34

Contributions to the West Virginia Prepaid Tuition Trust Fund ...........................................

34.

35.

Senior citizen or disability deduction

YOU

SPOUSE

(a) Income from sources not included

(a)

in lines 29 through 34 ...........................

(b)

$8,000 00

$8,000 00

(b) Maximum modification ..........................

(c)

(c) Add lines 29 through 31 above ..............

(d)

(d) Subtract line (c) from line (b) ................

35

(If less than zero, enter zero)

Enter smaller of (a) or (d) ...........................

36

36.

Surviving spouse deduction (use worksheet on page 14) ...................................................

37

Combine lines 29 through 36 for each column ...................................................................

37.

38

38.

TOTAL SUBTRACTIONS (line 37, Column A plus line 37, Column B). Enter on line 3 of Form IT-140 ...............

39

39.

Income tax from your 1999

return .........................................................................

NAME OF STATE

40

40.

West Virginia total income tax (line 8 of Form IT-140) ......................................................................... ..................

41

41.

Net income derived from above state included in West Virginia total income .........................................................

West Virginia income includes: Wage and Salary Income _______________ Other Income _______________

42

42.

West Virginia adjusted gross income (line 4 of Form IT-140) ................................................................................

43

43.

Limitation of credit (line 40 multiplied by line 41 and divided by line 42) .................................................................

44

44.

West Virginia taxable income (line 7 of Form IT-140) ........................................................................... .................

45

45.

Alternative West Virginia taxable income (line 44 minus line 41) ...........................................................................

46

46.

Alternative West Virginia total income tax (rate schedule applied to amount shown on line 45) ..............................

47

47.

Limitation of credit (line 40 minus line 46) .............................................................................................................

48

48.

Maximum credit (line 40 minus line 11 of Form IT-140) .........................................................................................

49

49.

Total credit (the SMALLEST of lines 39, 40, 43, 47, or 48). Enter on line 12 of Form IT-140 ...............................

A separate Schedule E must be completed for each state for which credit is claimed.

Remember to attach a copy of the other state's return; otherwise, your credit will be disallowed.

a

a. Enter your federal adjusted gross income from line 1 of Form IT-140 .....................................................................

If line a is greater than $10,000 ($5,000 if married filing separate returns), you are

not eligible for the exclusion. STOP HERE and enter zero on line 5 of Form IT-140.

b. List the source and amount of your earned income. Enter the total amount on line b

b

c

c. Maximum exclusion. Enter $5,000 if you marked filing status 2 in Section C; otherwise, enter $10,000 .................

d

d. Enter the smaller of the amounts shown on line b and line c here and on line 5 of Form IT-140 ..............................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2