Form 851-K - Kentucky Affiliations And Payment Schedule Instructions

ADVERTISEMENT

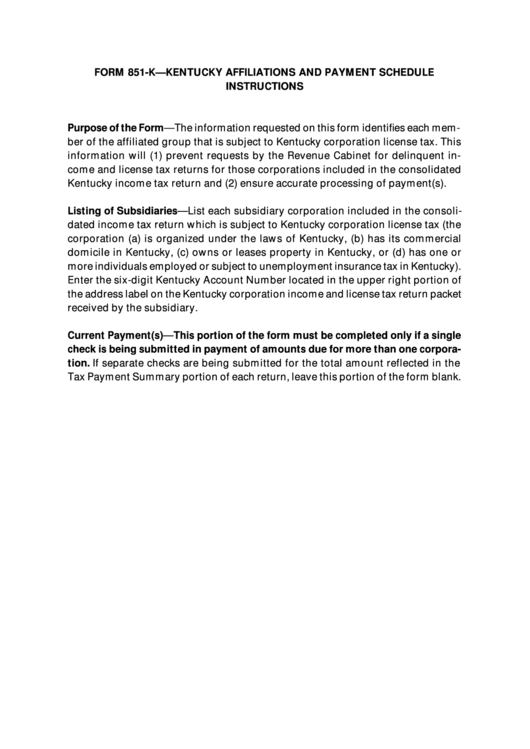

FORM 851-K—KENTUCKY AFFILIATIONS AND PAYMENT SCHEDULE

INSTRUCTIONS

Purpose of the Form—The information requested on this form identifies each mem-

ber of the affiliated group that is subject to Kentucky corporation license tax. This

information will (1) prevent requests by the Revenue Cabinet for delinquent in-

come and license tax returns for those corporations included in the consolidated

Kentucky income tax return and (2) ensure accurate processing of payment(s).

Listing of Subsidiaries—List each subsidiary corporation included in the consoli-

dated income tax return which is subject to Kentucky corporation license tax (the

corporation (a) is organized under the laws of Kentucky, (b) has its commercial

domicile in Kentucky, (c) owns or leases property in Kentucky, or (d) has one or

more individuals employed or subject to unemployment insurance tax in Kentucky).

Enter the six-digit Kentucky Account Number located in the upper right portion of

the address label on the Kentucky corporation income and license tax return packet

received by the subsidiary.

Current Payment(s)—This portion of the form must be completed only if a single

check is being submitted in payment of amounts due for more than one corpora-

tion. If separate checks are being submitted for the total amount reflected in the

Tax Payment Summary portion of each return, leave this portion of the form blank.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1