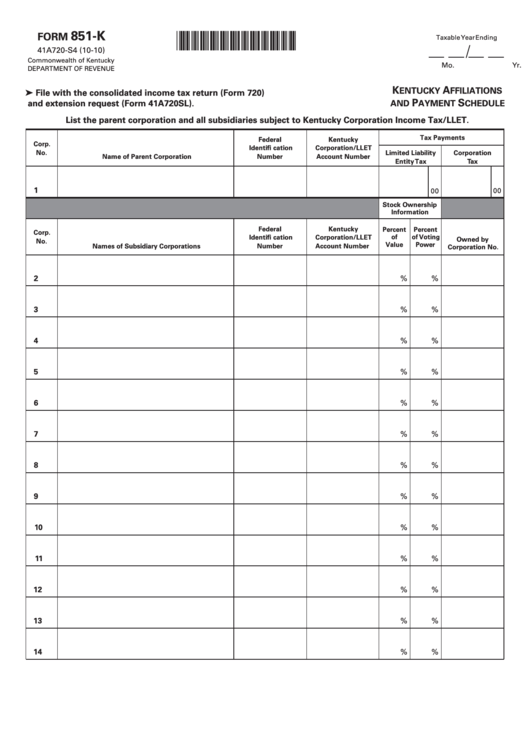

Form 851-K - Kentucky Affiliations And Payment Schedule - Kentucky Department Of Revenue

ADVERTISEMENT

851-K

*1000020208*

FORM

Taxable Year Ending

41A720-S4 (10-10)

Commonwealth of Kentucky

Mo.

Yr.

DEPARTMENT OF REVENUE

K

A

➤ File with the consolidated income tax return (Form 720)

ENTUCKY

FFILIATIONS

P

S

and extension request (Form 41A720SL).

AND

AYMENT

CHEDULE

List the parent corporation and all subsidiaries subject to Kentucky Corporation Income Tax/LLET.

Tax Payments

Federal

Kentucky

Corp.

Identifi cation

Corporation/LLET

No.

Limited Liability

Corporation

Name of Parent Corporation

Number

Account Number

Entity Tax

Tax

1

00

00

Stock Ownership

Information

Federal

Kentucky

Percent

Percent

Corp.

of

of Voting

Identifi cation

Corporation/LLET

Owned by

No.

Value

Power

Number

Account Number

Names of Subsidiary Corporations

Corporation No.

2

%

%

3

%

%

4

%

%

5

%

%

6

%

%

7

%

%

8

%

%

9

%

%

10

%

%

11

%

%

12

%

%

13

%

%

14

%

%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2