Form 332 Draft - Credit For Healthy Forest Enterprises - 2009 Page 3

ADVERTISEMENT

Name:

TIN:

AZ Form 332 (2009)

Page 3 of 3

Part IX Credit Recapture Summary

30 Enter the taxable year(s) in which you took a credit or credit carryover

for the disqualifi ed Healthy Forest Enterprise

31 Enter the total amount of credit originally allowable for the disqualifi ed Healthy Forest Enterprise...........................................

31

00

32 Enter the total amount of the credit to be recaptured

• Individuals, corporations, and S corporations - enter the amount from Part VI, line 20.

• S corporation shareholders - enter the amount from Part VII, line 25.

• Partners of a partnership - enter the amount from Part VIII, line 29 ....................................................................................

32

00

33 Subtract line 32 from line 31 and enter the result. This is the amount of credit allowable for

the disqualifi ed Healthy Forest Enterprise .................................................................................................................................

33

00

34 Amount of credit on line 31 that you have claimed on prior years’ returns ................................................................................

34

00

35 Subtract line 34 from line 33 and enter the result ......................................................................................................................

35

00

If the result is a positive number, that is the amount of credit carryover remaining that you may use in future taxable years. Enter this positive number in

Part X, column (d), on the line for the year in which the disqualifi ed credit arose.

If the result is a negative number, that is the amount of credit you must recapture. If a negative number, enter “zero” in Part X, column (d), on the line for

the year in which the disqualifi ed credit arose.

•

Corporations, also enter this amount as a positive number on Form 300, Part II, line 22.

•

Individuals, also enter this amount as a positive number on Form 301, Part II, line 30.

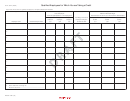

Part X

Available Credit Carryover

(a)

(b)

(c)

(d)

Available credit carryover -

Original credit

Amount

subtract column (c)

Taxable year

amount

previously used

from column (b)

36

37

38

39

40

Total available carryover

41

Part XI Total Available Credit

42 Current year’s credit. Individuals, corporations, or S corporations - enter the amount from Part V, line 14, column (d).

S corporation shareholders - enter the amount from Part VII, line 24.

Partners of a partnership - enter the amount from Part VIII, line 28 ..........................................................................................

42

00

43 Available credit carryover from Part X, line 41, column (d) ........................................................................................................

43

00

44 Total available credit. Add line 42 and line 43. Corporations and S corporations - enter total here and on Form 300,

Part I, line 12. Individuals - enter total here and on Form 301, Part I, line 18 ...........................................................................

44

00

ADOR 91-5497 (09)

DRAFT 09-14-09

DRAFT 09-14-09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5